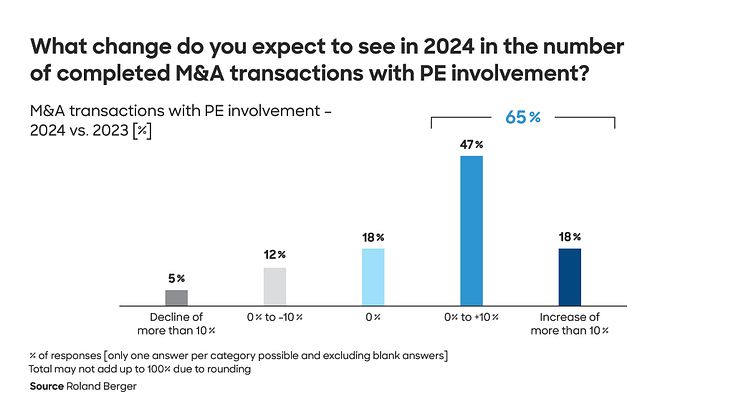

Positive momentum: European private equity sector expects increased level of M&A transactions with PE involvement

Study Download

Having fallen 24% in 2023, activity in the sector is on the rise again thanks to catch-up effects, economic recovery and easier financing conditions

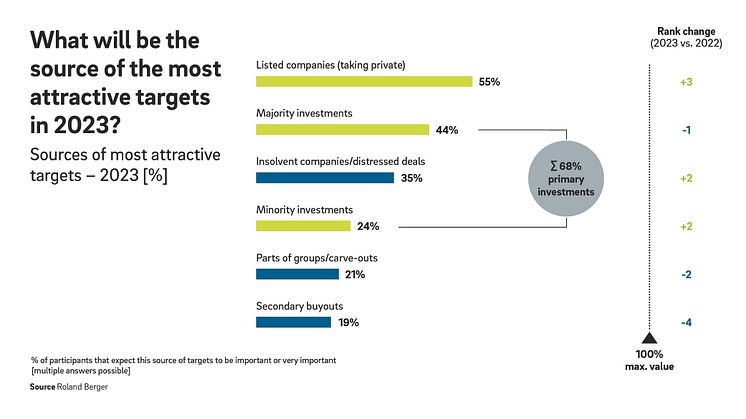

Investment targets are growing more attractive, with a particular focus on the technology and pharma industries

Transactions are expected mainly in the small- and mid-cap segments, where less debt financing is needed

Munich, Ma