Press release -

Private equity: Lack of availability of debt financing dampens transaction activity

- Nordic countries and Spain and Portugal are set to see the highest growth in M&A activity in 2023

- Strong focus on small- and mid-cap segments

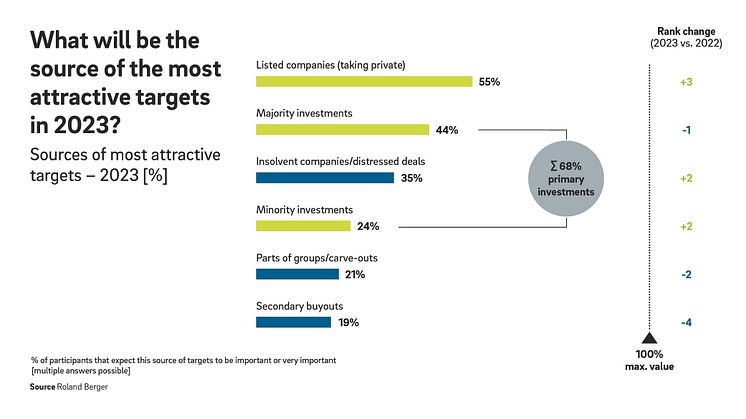

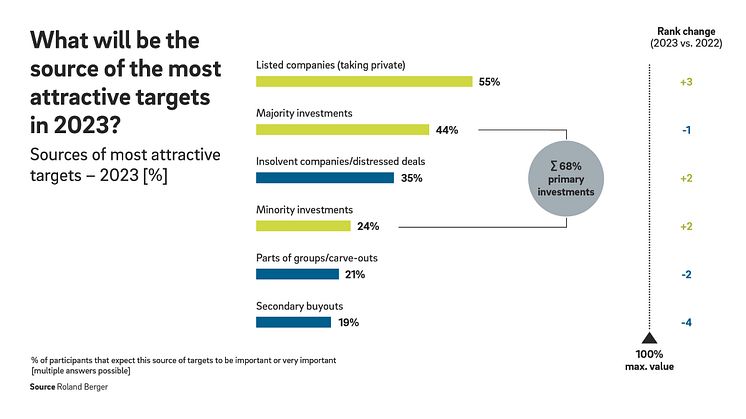

- Primary investments (68%) and taking public companies private (55%) are the focus of PE activity

Munich, April 2023: Europe's private equity industry is initially rather cautious about the current year’s development. Almost 60% of professionals expect the number of M&A deals with PE involvement to be about the same as the previous year's low level. Geopolitical risks and rising interest rates are the reasons. The reduced amount of debt financing available as a result of this is considered to be a key factor in future developments in the industry. These are among the findings of the "European Private Equity Outlook 2023" for which Roland Berger surveyed around 1,700 PE experts across Europe.

"The considerable economic and political uncertainty we are currently experiencing is having an impact on private equity too," says Christof Huth, Partner at Roland Berger. "COVID-19 is no longer seen by industry professionals as a major issue. The dominant factor is the availability of debt financing, which is being impacted by rising interest rates. External financing for large deals is quite hard to access in the current market. This means that value creation initiatives within the portfolio are more of a focus this year. That being said, the market does still offer plenty of interesting assets in the small-cap and mid-cap segments. PE professionals are once more looking increasingly towards listed companies and primary investments."

The situation varies considerably among the different European countries: While experts expect M&A activity in the Nordic countries, Spain and Portugal to grow by more than 10% in some cases, the outlook for Italy, Central & Eastern Europe and the UK is muted. For Germany, Switzerland and Austria, survey respondents expect at most a slight increase in activity.

Debt financing is a key driver

Almost all of the PE experts consider the availability of debt financing (91%; 2022: 35%) and the general economic situation (90%; 2022: 74%) to be the biggest factors that are set to impact future developments. Almost six in ten survey respondents believe that high energy costs and consumer confidence are having a major influence on PE activity. Mentioned by just 4% of experts, the pandemic is barely a factor anymore (2022: 45%).

PE trends for 2023: Primary investments, pharmaceutical targets and small caps

Primary investment opportunities, i.e. majority (44%) and minority (24%) investments, are viewed by more than two-thirds of PE professionals as the most important source of attractive targets. These investments still offer considerable potential for value creation, which has become a priority for PE firms. Listed companies have seen the biggest increase in attractiveness at 55%, up from 13% in 2022. Secondary buyouts are now least relevant, mentioned by just 19% of experts (down from 60% in 2022).

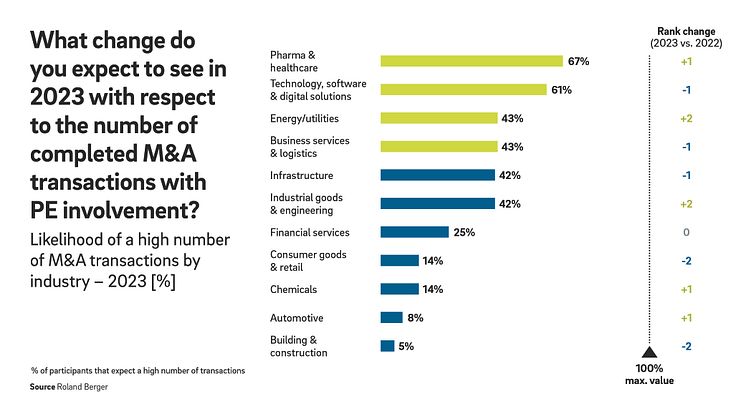

Pharma & healthcare and technology, software & digital solutions continue to be seen as the two most attractive target sectors. Altogether 67% and 61% of experts anticipate a high number of transactions with PE involvement in these industries, respectively. The energy sector now places third at 43%, having been back in fifth place in 2022 behind business services and infrastructure. "Assets in the renewable energy sector are of increasing interest to private equity funds. They will play an important role for future investments as the energy transition progresses," says Huth.

Looking at transaction volumes, the small-cap (deals valued at up to EUR 100 million) and mid-cap (EUR 100 to 249 million) segments are seen by PE professionals as the most promising target classes. This is explained by the fact that these are less dependent on large-scale external financing, according to the study authors. Furthermore, there has been a big increase in the number of respondents who believe that valuation multiples are fairly valued: 21% of experts now hold this view compared to 8% in 2022.

ESG is now a highly relevant value creation measure

Value creation is becoming increasingly important: 89% (2022: 54%) and 92% (2022: 71%) of respondents believe it will have an important or very important role in 2023 and the next 5 years, respectively. "Especially in times of increased interest rates, investors are constantly looking for additional ways of creating value beyond just buying low and selling high," says Huth. "Our survey of PE experts found that the key value creation measures for the next five years include ESG, cycle resilience and digitalization of portfolio companies."

Topics

Categories

Roland Berger is the only management consultancy of European heritage with a strong international footprint. As an independent firm, solely owned by our Partners, we operate 51 offices in all major markets. Our 3000 employees offer a unique combination of an analytical approach and an empathic attitude. Driven by our values of entrepreneurship, excellence and empathy, we at Roland Berger are convinced that the world needs a new sustainable paradigm that takes the entire value cycle into account. Working in cross-competence teams across all relevant industries and business functions, we provide the best expertise to meet the profound challenges of today and tomorrow.