Press release -

Positive momentum: European private equity sector expects increased level of M&A transactions with PE involvement

- Having fallen 24% in 2023, activity in the sector is on the rise again thanks to catch-up effects, economic recovery and easier financing conditions

- Investment targets are growing more attractive, with a particular focus on the technology and pharma industries

- Transactions are expected mainly in the small- and mid-cap segments, where less debt financing is needed

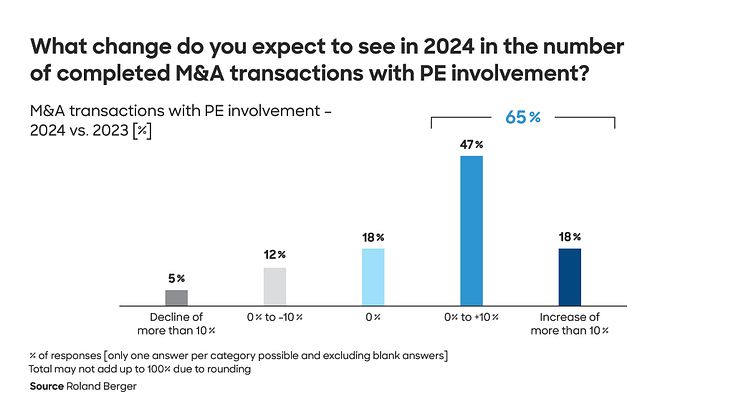

Munich, March 2024: The Sentiment in Europe's private equity sector is more optimistic than it was last year: Whereas in 2023, 60% of industry experts predicted stagnation, this year 65% anticipate a higher volume of M&A transactions involving private equity (PE). This expectation is primarily driven by the anticipated easing of financing conditions and the perception of greater investment opportunities. Technology, software & digital solutions and pharma & healthcare are the most attractive target industries in 2024, driving M&A transactions with PE involvement. These are some key findings of the “European Private Equity Outlook 2024”, the 15th consecutive publication in a series by Roland Berger, for which the consultancy surveyed 2,200 PE experts across Europe.

"The shift in sentiment in the industry can be attributed to various factors," says Christof Huth, Partner at Roland Berger. "As we anticipated in last year's PE Outlook, there was indeed a marked decline by 24% in PE-involved M&A activity in 2023 compared to 2022 – influenced by rising inflation, higher interest rates and other unfavorable macroeconomic conditions. The economic outlook for 2024 appears more promising, with stable or potentially lower interest rates and a recovery anticipated across most key European economies. Additionally, many of the postponed deals are expected to be executed in 2024." 90% of respondents expect the investment targets available in 2024 to be at least as attractive or more attractive than last year – only 72% held this expectation in 2023.

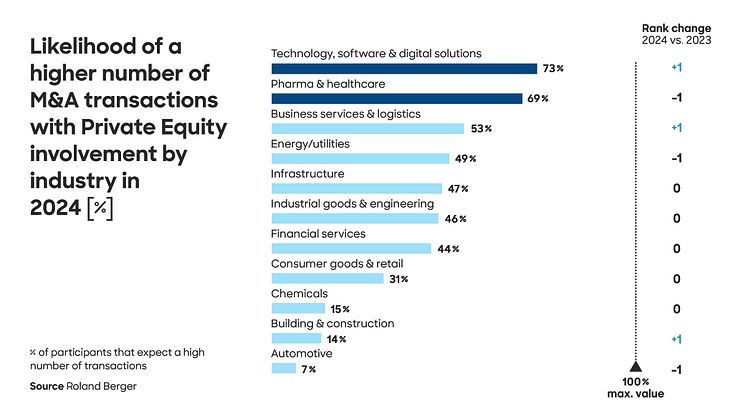

Industries of particular interest to PE are those that exhibit fundamental growth characteristics, resilience and scalability. Consequently, PE experts expect most deals in 2024 to be in the technology, software & digital solutions (73%) and pharma & healthcare (69%) industries: The key areas for the first field are software-as-a-service (SaaS) and digital transformation solutions, including data analytics, hyper-automation and artificial intelligence. In the pharma & healthcare sector, the focus will be on product portfolio expansion and strengthening the supply chain.

Fundraising, overall economic situation and valuations are the key factors

The experts expect to see a rising number of PE transactions especially in the small- and mid-cap segments (deal value of below EUR 100 m and EUR 100 to 499 m, respectively). This is due to the smaller amount of debt needed. The availability of debt financing is still identified by 81% of respondents (2023: 91%) as the primary factor influencing the PE industry, but the situation is believed to have eased somewhat: Intense competition for fundraising is anticipated by just 54%, a much lower figure than in 2023 (78%). Further critical factors this year are the overall economic situation (81%) and the evaluation of M&A targets (80%).

Asked about the focus of their PE activities in 2024 and over the next five years, many more respondents than last year (41% vs. 16%) cited the development of portfolio companies as their priority. "PE professionals expect the integration of artificial intelligence in business processes to bring the highest benefits," says Huth. "Not only will that create value, but AI is also beneficial for the due diligence process. In addition, digitalization in general and optimization around ESG criteria are also top of the agenda."

Topics

Categories

Roland Berger is a leading global strategy consultancy with a broad range of services for all relevant industries and corporate functions. Roland Berger was founded in 1967 and is headquartered in Munich. The strategy consultancy is best known for its expertise in transformation, cross-industry innovation and performance improvement and is committed to embedding sustainability in all its projects. In 2022, Roland Berger recorded a turnover of around 870 million euros.