Press release -

Financial service providers aren't keeping pace with digitalization despite some progress – As the customer interface gets crowded they are increasingly losing direct customer contact

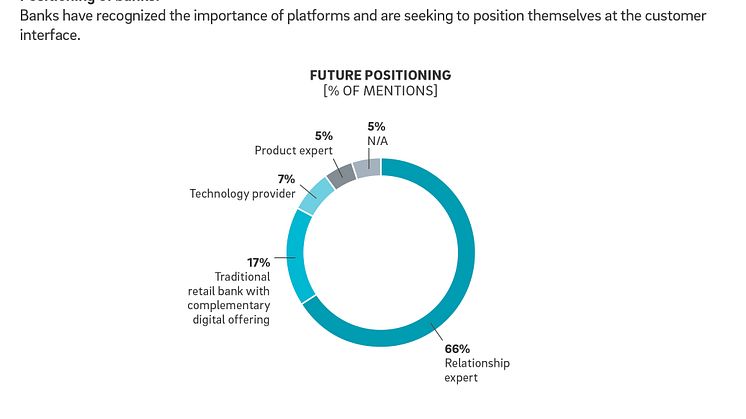

Munich, August 2018: Digitalization and new business models have created a growing gap between product creation and product sales in the banking sector. Digital platforms are already giving incumbent banks' competitors access to the majority of their customer base and could enable them to market their services to consumers on an even greater scale in the future. Retail banks are thus faced with basic strategic decisions at this point in time: They can opt to remain at the customer interface and actively configure and use platforms to facilitate this positioning or they can become known as primarily a product expert in the future. As Roland Berger's "European Retail Banking Survey" (Download study here) found, two-thirds of financial institutes are still aiming to position themselves as the interface to banking customers. That said, they are currently too busy trying to digitalize their conventional business model: Only two percent of traditional retail banks see themselves as drivers of innovation.

"Retail banks have not really managed to close the gap to the digital frontrunners yet," said Wolfgang Hach, a Roland Berger Partner. "They are undeniably digitalizing their existing business models and processes, but they haven't done much about implementing real digital disruptions. In many cases, banks are currently leaving it to other players, especially the big technology providers and the FinTechs, to shape the future of retail banking."

The digital platform economy is revolutionizing the financial sector

Banks have indeed seen their processes speed up in recent years: Accounts can be opened faster, consumer loans taken out quicker and even complex products like mortgage loans provided within much shorter timeframes today. Nevertheless, "Many banks still think too much along the lines of traditional products and processes," said Roland Berger Partner Sebastian Steger. "That often leaves no room for genuine innovation."

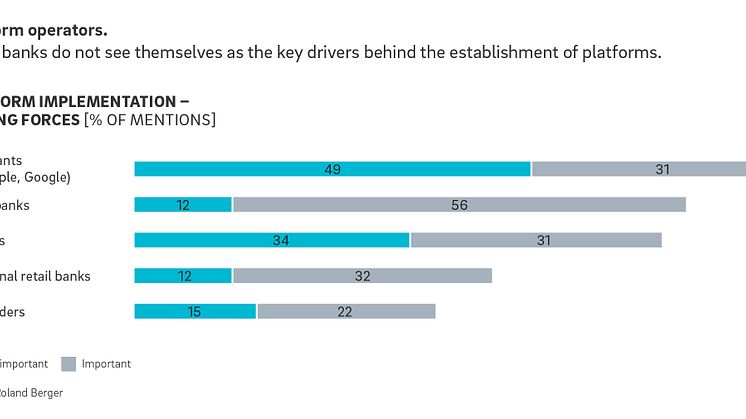

Retail banks are well aware of their shortcomings: Asked to name the innovation frontrunners in the banking sector, only two percent of the Roland Berger survey's respondents mentioned traditional retail banks, whereas 47 percent cited the tech giants. And when the banks were asked to state who was driving the establishment of banking platforms, they themselves came only fourth (44%) after the tech giants (80%), direct banks (68%) and FinTechs (65%). This is incompatible with a future in which retail banks see themselves as the customer interface.

Time is running out, as evidenced by developments in other industries that have seen themselves turned upside down by the disruption of the platform economy. Just look at airlines, which often don't even sell their own flights anymore – tickets are frequently sold over platforms instead. A similar pace of development is already underway in the banking sector. Platforms already account for a significant share of the market for retail products, in particular, which make up more than 30 percent of the new business – a figure that is rising fast.

Not all banks will be able to position themselves at the customer interface

If they are to catch up with the digital frontrunners, banks need to fundamentally realign their business, which includes breaking away from their legacy culture. "Many retail banking players grew up in a world where they didn't have to decide whether to focus on customer access or product offering," said Steger. "But the traditional positioning with a universal offering and maximum depth and breadth of value creation no longer works in the platform world." Therefore, retail banks should, first of all, establish what would be a clear and realistic strategy for them to adopt and decide where their future focus will lie: They can be either relationship expert, product expert or technology provider. Although 66 percent of the banks polled say they want to position themselves at the customer interface, Steger sounds a note of caution: "Not every bank will ultimately be successful with their own digital offering or even their own platform, not least because platforms are only attractive when they bring large numbers of users and products or services together. That's why it's important for banks to identify exactly where their strengths lie and design their business model accordingly."

Once the fundamental decision has been made, banks can get on with its consistent implementation, taking care to choose the right way of going about it. "It's not a matter of adopting a single digital implementation model that applies to all possible scenarios," said Hach. "There is no one-size-fits-all answer to digital transformation." The Roland Berger experts point out that the key is to have a clear vision and to combine it with flexible implementation models and to bring a modern mindset and agile working methods into the organization and get them embedded in the culture. At the same time, banks should develop their innovative, digital solutions separately from their existing technical infrastructures and systems – at least in part. "As a rule of thumb, the more innovative, disruptive and uncertain the expected outcome, the more agile and flexible the approach needs to be," said Hach in summary.

Categories

Roland Berger, founded in 1967, is the only leading global consultancy of German heritage and European origin. With 2,400 employees working from 35 countries, we have successful operations in all major international markets. Our 52 offices are located in the key global business hubs. The consultancy is an independent partnership owned exclusively by 230 Partners.

For further information, please contact:

Roland Berger

Maximilian Mittereder

Press Team

Tel.: +49 89 9230-8180