Press release -

Time to act: Vehicle electrification will reshape the European Aftermarket

- Electric vehicles are set to make up 53 to 82% of all new vehicles below 3.5 tons sold in Europe by 2030

- Aggressive sales scenario: 2038 could be the first year with more than 50% battery-electric vehicles on the road

- Electric cars need around 30%fewer aftermarket components, but create significant new opportunities

Munich/Brussels, September 2022: The ongoing electrification transition in the automotive sector indicates a massive change for the European aftermarket. The reasons: Battery electric vehicles (BEVs) have around 30% lower demand for traditional aftermarket components and BEV sales forecasts project a 53 to 82% market share in 2030. These are the findings of a joint study by Roland Berger and CLEPA, the European Association of Automotive Suppliers. The authors have formulated three future scenarios and recommend steps the industry can take to shape the transformation.

"For automotive aftermarket players, planning for the transition to electrification is a very complex business because many vehicles in our fleet will still have an internal combustion engine after 2035," says Hasmeet Kaur, Partner at Roland Berger. "Even though electric vehicles currently make up only 0.8% of the vehicle parc, players need to reposition themselves now to ensure their success going forward."

The automotive industry has been undergoing a rapid transformation for several years now. A combination of technology trends, changing customer behavior, the various supply shortages and the proposed regulation of the European Union (EU), which only recently was agreed on by the EU council, have put companies under pressure. Electrification is expected to massively impact the forces at play in the aftermarket.

The EV transition is underway: Outlook for 2030 and 2035

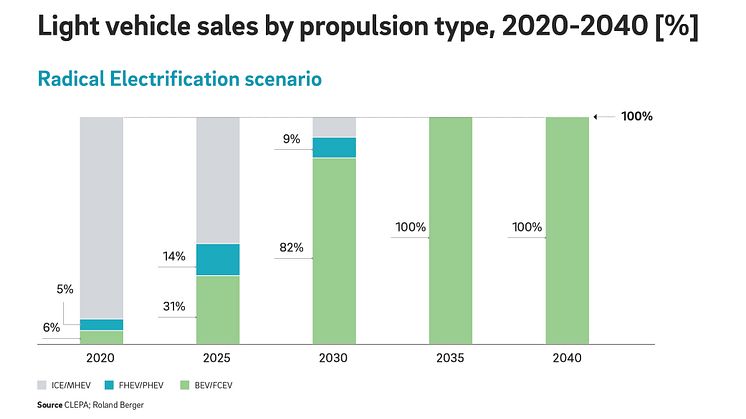

The study authors developed three scenarios and in each of them calculated the effects of the different pace of electrification on the automotive aftermarket. The most bullish scenario ("Radical Electrification") sees electric mobility making a rapid breakthrough. This causes the share of battery-electric vehicles in total new vehicles below 3.5 tons sales to rise to 82% in 2030 and reach 100% from 2035 onwards.

The middle scenario ("Ambitious Transformation") is based on the policy and corporate goals as they currently stand. In it, prices for the raw materials needed to manufacture batteries stabilise, and a suitable charging infrastructure is established. As a result, the share of electric cars in total vehicle sales grows to 68% by 2030 and hits 100% from 2035 onwards.

In the least progressive scenario ("Regulatory Compliance"), progress towards BEV-only is moderated by various headwinds, including rising battery raw material costs. The share of electric cars in total vehicle sales rises to 53% in 2030 and 96% in 2035, before reaching 99% in 2040.

Drop in demand for traditional drivetrains and engines

The increased market penetration of battery-electric vehicles will change both the importance of the various product categories in the aftermarket and the roles of the companies that operate in it. The authors analysed 250 components along 53 vehicle systems and expect battery-electric vehicles to offer about 30% lower sales potential for traditional aftermarket components, compared to internal combustion engine vehicles. The reasons: battery-electric vehicles are built with fewer components and there is less wear and tear on the engine, the drivetrain and the brake components, among others.

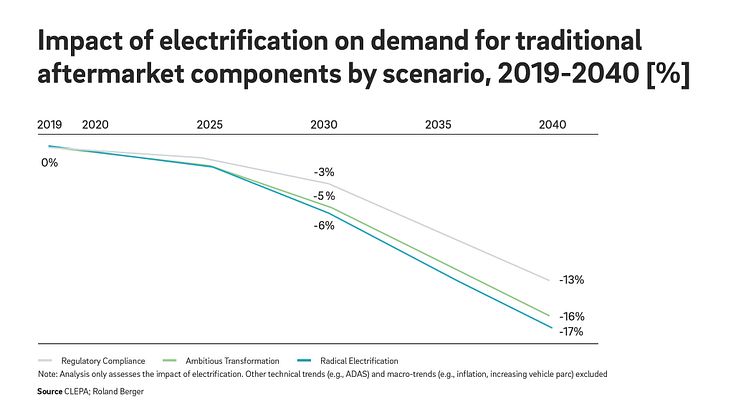

For each of these components, the study estimates the impact, both negative and positive, on "gross" demand on the aftermarket (excluding additional demand for new components and services, such as labour in workshops or software updates). In order to show the impact of electrification clearly, the study specifically excludes other macro factors such as the impact of the expected overall growth of the vehicle parc or inflation, and technical trends such as Advanced Driver Assistance Systems. In the Radical Electrification scenario, a drop of 12% by 2035 and 17% by 2040 is forecasted. The product categories most affected are the internal combustion engine and the drivetrain, where demand will fall by 49 and 51%, respectively. In the Regulatory Compliance scenario, the impact is expected to be reduced to -13% by 2040.

New opportunities for industry players across the board

Electrification also opens up new opportunities along the value chain for the various suppliers in the industry. Parts manufacturers, for example, can shift their portfolio to battery-specific components but also expand their business model by remanufacturing or refurbishing components. A further opportunity is to offer diagnostics and flashing solutions to support workshops, particularly with the challenging software and data management of battery-electric vehicles with new electronics and connectivity platforms. Partnering with battery specialists can help both the traditional aftermarket supplier and the battery specialist.

"It will be especially important for aftermarket players to develop remanufacturing and repairing capabilities for battery systems, electric motors, e-axles and power electronics," says Frank Schlehuber, Senior Consultant Market Affairs at CLEPA. "We expect to see a shift in aftermarket services from hardware to software. Preventive maintenance will also gain relevance, given that the battery is safety-critical."

Wholesale distributors will be able to assist in the management of end-of-life components, becoming providers of recycled materials or offering their logistics networks to new customer groups. And workshops have the option of positioning themselves as battery-electric vehicle specialists and offering services to generalist workshops in their area. They can also offer their services to OEMs looking for IAM workshop partners to strengthen their service network.

Additionally, the study will be presented at Automechanika, on 13 September 2022, 11.00-11.30 CET in Hall 9, Level 0, D88.

Topics

Categories

Roland Berger

Roland Berger is the only strategy consultancy of European origin with a strong international presence. As an independent firm owned exclusively by our partners, we have 51 offices with a presence in all major markets. Our 2,700 employees are characterized by a unique combination of analytical thinking and an empathetic mindset. Driven by our values of entrepreneurial spirit, excellence, and empathy, we are convinced that business and society need a new, sustainable paradigm that focuses on the whole value-creation cycle. By working in interdisciplinary teams across all relevant sectors and business functions, Roland Berger offers the best expertise worldwide for successfully overcoming the profound challenges of our age now and in the future.

CLEPA, the European Association of Automotive Suppliers

CLEPA, the European Association of Automotive Suppliers based in Brussels, represents over 3,000 companies, from multi-nationals to SMEs, supplying state-of-the-art components and innovative technology for safe, smart, and sustainable mobility, investing over €30 billion yearly in research and development. Automotive suppliers directly employ 1.7 million people in the EU.