Press release -

Study: Increasing expenses and strong regional differences will shape global consumer behavior in 2024

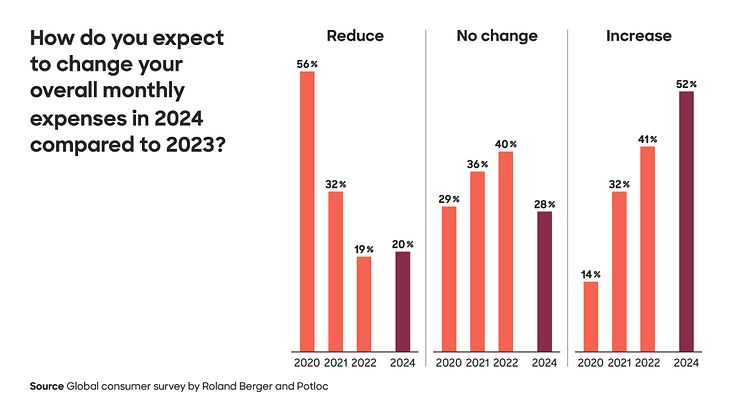

- 52% of consumers surveyed expect their consumer spending to increase in 2024 – partly driven by high inflation

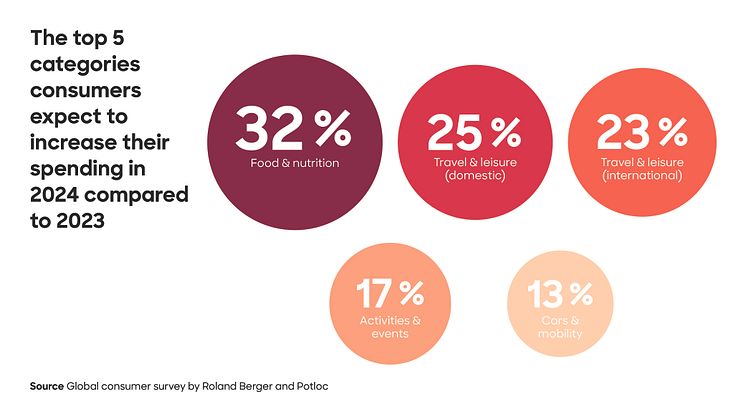

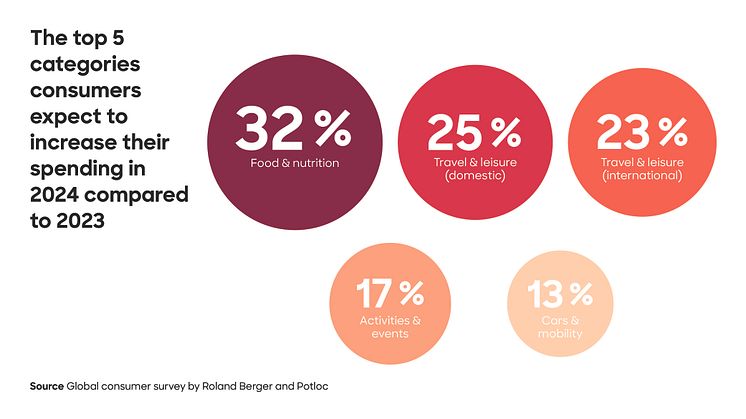

- Just under a third (32%) expect to increase their spending on healthy eating

- 45% plan to visit physical supermarkets more often

Munich, February 2024: Consumer behavior for 2024 is more diverse than ever – their expectations and the way they spend money vary significantly between regions. This is among the findings of the latest study "Global retail and brands at a crossroads – Navigating economic uncertainty and varying consumer expectations in 2024" by Roland Berger and Potloc, the third edition in a series of publications. For this year's global study, 1,800 consumers from Germany, China, Brazil, the UK, the USA and the United Arab Emirates (UAE) were asked about their consumer behavior in 2024. While 56% of those polled back in 2020 expected to reduce their monthly consumer spending, the tide is now slowly turning: At 52%, just over half of the global study participants expect their spending to increase in 2024. Yet, this is also driven by high inflation. Against the backdrop of the economic and geopolitical situation, only 9% of respondents say they are extremely optimistic, with 17% feeling very optimistic.

"Despite significant regional differences, our latest survey indicates that people are showing a tendency to increase their monthly spending on consumer goods," says Thorsten de Boer, Partner at Roland Berger. "Respondents from China, the USA and the UAE express greater optimism than those from Europe and Brazil. German consumers in particular expect to be more price-conscious – partly due to high inflation – for instance by doing more of their shopping at discount stores."

Traditional purchasing criteria such as value for money and quality are essential

Value for money (24%), absolute price (20%) as well as quality and durability (17%) are the key criteria that consumers apply to their purchasing decisions. When buying luxury goods, German consumers in particular focus on quality and durability (64%). On average worldwide, however, only 45% mention this criterion.

Looking into what consumers plan to spend more money on, the study reveals that the answer is food and travel. Healthy eating and food are the top priority for almost a third (32%) of survey participants. A quarter (25%) of those polled expect to increase their spending on domestic travel, while 23% of respondents intend to invest more on foreign travel.

Shopping local remains attractive despite the online retail boom

Another emerging trend is that shopping local retains its appeal, even though online shopping became much more important due to the pandemic. Around 45% of study participants plan to shop in supermarkets more often in 2024 than they did the previous year. Shopping malls are also popular, with 33% of respondents planning to visit them more frequently. Consumers in China, Brazil and the UAE in particular expect to make more frequent use of the convenience and variety offered by malls.

When it comes to attracting consumers to physical stores, promotions and vouchers are particularly effective measures. Half (50%) of those polled said that these would make them more willing to visit a store. For 33% of study participants, special membership benefits would increase their motivation to visit a store. This applies particularly to consumers from the USA. German consumers, on the contrary, value good, personal service in stores.

Even though brick-and-mortar retail is experiencing renewed growth, 46% of respondents expect to do more shopping at large online marketplaces this year. This is primarily because of the ability of online platforms to ensure consistently competitive prices and reliable delivery, even in times of inflation and supply chain challenges.

Customer centricity is becoming increasingly important

The study findings also highlight the importance of being even more customer-centric in the future. "Brands and retailers need to invest in technologies that enable advertising and customer interaction to be individually optimized. For example, company-specific loyalty programs can reward consumers for repeat purchases and provide them with tailored offers," said Richard Federowski, Partner at Roland Berger. "At the same time, the continuous interaction with the customer creates an extensive pool of data that retailers can use not only for targeted marketing but also to gain valuable insights for assortment planning and product improvement."

Topics

Categories

Roland Berger is the only management consultancy of European heritage with a strong international footprint. As an independent firm, solely owned by our Partners, we operate 51 offices in all major markets. Our 3000 employees offer a unique combination of an analytical approach and an empathic attitude. Driven by our values of entrepreneurship, excellence and empathy, we at Roland Berger are convinced that the world needs a new sustainable paradigm that takes the entire value cycle into account. Working in cross-competence teams across all relevant industries and business functions, we provide the best expertise to meet the profound challenges of today and tomorrow.