Press release -

Majority of consumers buy from multi-brand channels, while direct-to-consumer retailers lose important consumer touchpoints

- Roland Berger surveyed over 1,800 consumers in the major markets of Germany, the United States and Japan about their shopping behavior

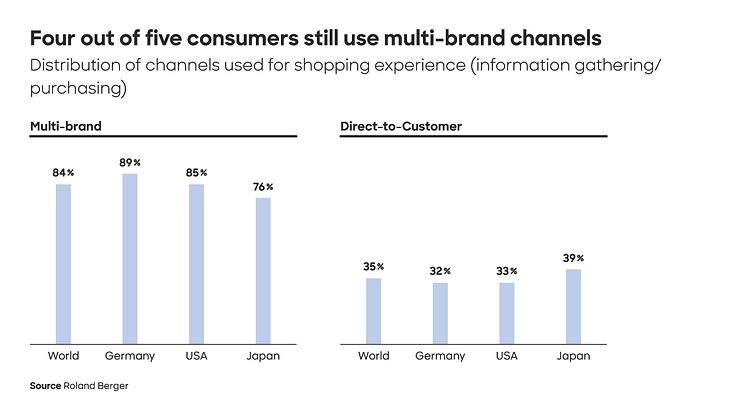

- 84% prefer to buy from offline and online multi-brand channels and 35% from direct-to-consumer channels; the path to purchase often leads through several channels

- Retailers should align their distribution strategy with their customers' expectations and use all channels optimally

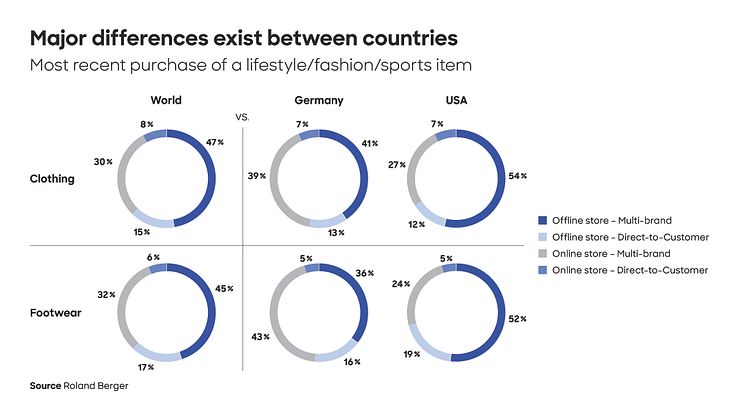

Munich, June 2024: Most consumers prefer to do their fashion and lifestyle shopping through channels offering multiple brands. This is among the findings of the Roland Berger study "Rethink your distribution play", for which more than 1,800 consumers in the United States, Germany and Japan were surveyed: 84% of consumers prefer multi-brand channels both for gathering information about a product and for shopping, either online or in-store. By contrast, online and offline direct-to-consumer (D2C) channels are less important: just over one-third of respondents (35%) stated that they shop through D2C channels. Preferences differ between regions: the share of consumers who use multi-brand channels is higher in Germany (89%) than it is in the United States (85%) and Japan (76%); at the same time, significantly more Germans shop online (39% to 43% depending on the product) than Americans (24% to 27%). Overall, the findings reveal that companies lose important consumer touchpoints if they concentrate only or mainly on their own D2C sales channels. What they need instead is an omnichannel offering and an individual strategy for each channel that is geared towards consumer expectations.

"There has been a lot of hype around D2C business in recent years," says Faris Momani, Partner at Roland Berger. The reason? "Compared with selling through multi-brand channels, D2C offers companies the benefits of full control over their brand positioning, access to valuable consumer data and potentially a higher share of margins. But our study clearly shows that consumers prefer to shop in multi-brand channels, and that their path to purchase also crosses a number of different channels." For example, 61% of those who purchased a product through a D2C channel reported having previously gathered information exclusively or additionally through other online and offline channels. Those who bought from a multi-brand channel still used other channels for information-gathering in 42% of cases. This means: "Omnichannel interactions are common, and companies that do not have a presence in all channels risk being overlooked," says Momani.

German consumers are more online-savvy than US shoppers

A consumer preference for multi-brand channels is clear across all three countries but is higher in Germany (89%) than in the United States (85%) and Japan (76%). The share of those who shop online is also highest in Germany: 39% of German consumers use online multi-brand channels when buying clothing and 43% do so when buying shoes, compared to just 27% and 24%, respectively, in the United States. Companies should take these differences into account in their distribution strategy. Another factor is the age of the target group: the younger the customers, the greater their likelihood to engage in omnichannel interactions. For example, between 16% and 38% of people under 35 years of age who shop in offline multi-brand stores use other channels for information-gathering before making a purchase. Among respondents aged 51 and over, only between 6% and 21% do so.

Roland Berger expert Momani derives two main findings from the study: "First, D2C will continue to play an important role in companies' overall strategy. Second, only an omnichannel distribution approach can fully cover the whole complexity of consumer preferences, deliver an optimal consumer experience and utilize the strengths of both D2C and multi-brand channels. Companies should therefore first consider how well they know and understand their consumers. Then they need to assess the suitability of their existing sales channels and, if necessary, realign their distribution strategy."

Topics

Categories

Roland Berger is one of the world's leading strategy consultancies with a wide-ranging service portfolio for all relevant industries and business functions. Founded in 1967, Roland Berger is headquartered in Munich. Renowned for its expertise in transformation, innovation across all industries and performance improvement, the consultancy has set itself the goal of embedding sustainability in all its projects. Roland Berger revenues stood at more than 1 billion euros in 2023.