Press release -

Global semiconductor shortage to persist for several years beyond 2022

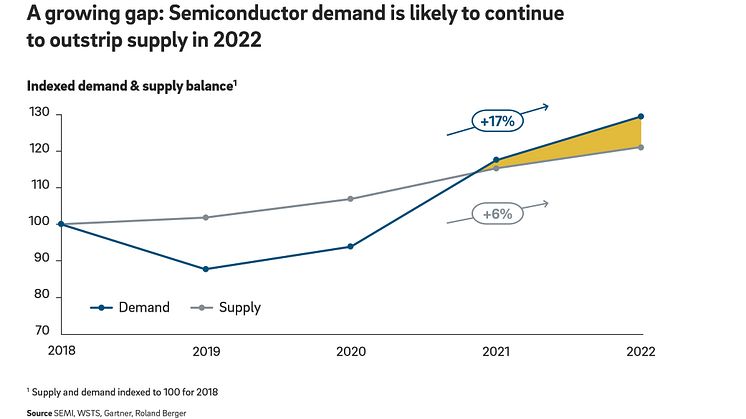

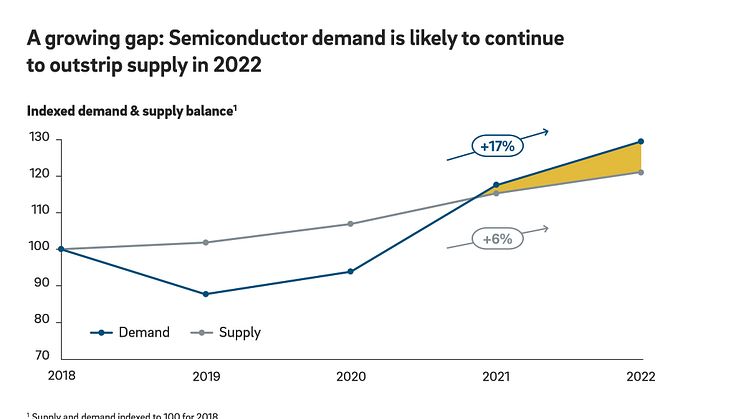

- Chip demand set to rise 17% per year from 2020 to 2022, while supply will grow only 6% per year

- Additional capacity is not being built up in older semiconductors and will not offer relief in the short term

- The automotive industry's current design philosophy still relies on older chip generations, making it harder hit than other industries by the shortage

Munich, December 2021: The global semiconductor shortage is expected to last beyond 2022 for the automotive industry and many other sectors and will continue for several years. The biggest shortages are seen in older generation chips, the legacy semiconductors on which the automotive industry is reliant. But additional manufacturing capacities are mainly being built up in newer generations, meaning that these investments will offer little relief. These are among the key findings of the study "Steering through the semiconductor crisis. A sustained structural disruption requires strategic responses by the automotive industry" by Roland Berger.

"The gap between semiconductor supply and demand is getting bigger and bigger," says Falk Meissner, Partner at Roland Berger. "There is no improvement in prospect anytime soon. That is because the reasons for the supply crunch are structural and related to the way supply chains are currently set up. The shortage of chips will persist into 2023 – and probably beyond. The capacity expansions that have been announced are not enough to meet demand."

Current demand for chips exceeds production capacity by far

The Roland Berger experts' analyses indicate that chip demand will increase by 17% per year from 2020 to 2022. Yet production capacity will rise by only 6% per year in the same period. Logic (40nm nodes and older), analog chips and MEMS are the semiconductor segments where the shortages are expected to persist the longest. With semiconductor factories already running at 97% capacity on average, a rapid expansion of production is not realistically possible.

Added to that, some car manufacturers are already switching from a just-in-time to a just-in-case approach and thus overstocking semiconductors. In the short term, this aggravates the supply shortage even more.

Transformation in semiconductor architecture

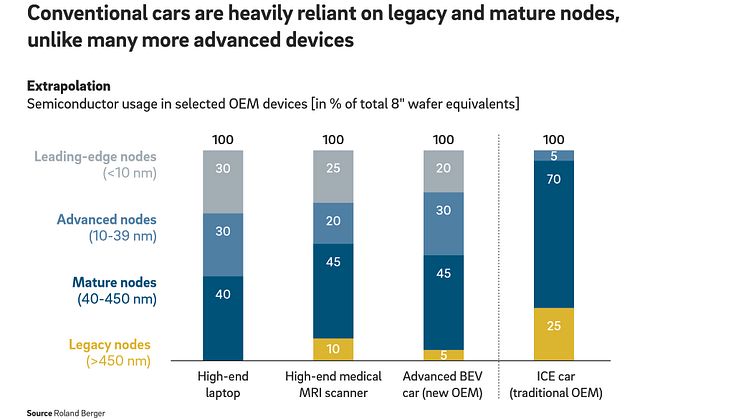

New manufacturing capacity is not going to resolve the massive supply shortage in the automotive industry because the investment is focused mainly on the latest generation of leading-edge nodes. Yet the older generation chips are where the biggest shortages are – where manufacturing technology dates from the 1990s and 2000s. It is these that make up the lion's share of semiconductors in the current electronics architectures of cars with internal combustion engines, accounting for 95% of the chips installed. By contrast, latest generation chips account for just 5%.

The automotive industry is already in the process of transitioning to new electronic vehicle architectures. Technology and automotive company experts interviewed for the study believe it will take traditional manufacturers more than five years to complete the transition.

Semiconductor customers will need to adapt their strategy

Companies from the automotive industry and other sectors that rely on semiconductors need to actively address the crisis. This will include taking technical measures such as transitioning more quickly to centralized/zonal E/E architectures. In addition, direct, long-term supply contracts with semiconductor companies that include reciprocal capacity commitments and purchase obligations over several years are an important lever. "In the long term, OEMs and suppliers must adapt their design philosophies to keep pace with the dynamic capacity changes in the semiconductor industry. Addressing the crisis requires strategic action," so Meissner.

Topics

Categories

Roland Berger is the only management consultancy of European heritage with a strong international footprint. As an independent firm, solely owned by our partners, we operate 50 offices in all major markets. Our 2400 employees offer a unique combination of an analytical approach and an empathic attitude. Driven by our values of entrepreneurship, excellence and empathy, we at Roland Berger are convinced that the world needs a new sustainable paradigm that takes the entire value cycle into account. Working in cross-competence teams across all relevant industries and business functions, we provide the best expertise to meet the profound challenges of today and tomorrow.