Press release -

Global battery market continues to see strong growth despite uncertainties and holds opportunities for European manufacturers

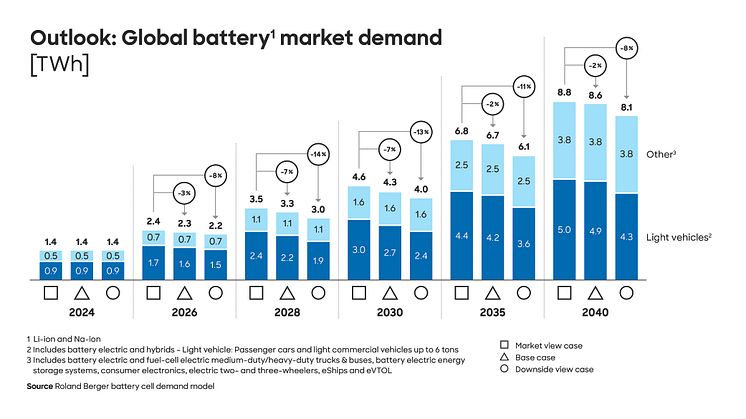

- Battery Monitor 2024/2025 by Roland Berger and RWTH Aachen: Demand set to triple to as much as 4.6 terawatt hours by 2030 before doubling again by 2040

- Europe's market is shaped by Asian cell manufacturers' price war as well as local overcapacity due to overly optimistic demand expectations

- New European players must show they can produce high-quality battery cells at low cost – partnering with leading Asian competitors may be a smart move

Munich/Aachen, February 2025: Global demand for batteries will grow more than threefold by 2030, rising to between 4.0 and 4.6 terawatt hours depending on the specific scenario. The market is currently dominated by technology-leading cell manufacturers from Asia – especially China, where the substantial overcapacity is causing a drop in prices worldwide. This is adding to the pressure on European cell manufacturers in particular, who are already struggling with higher production costs and uncertainties over the further ramp-up of electric mobility. Nevertheless, Europe has the potential to become a major player in battery manufacturing, boasting competitive advantages in terms of innovation, high-quality process technologies and the carbon footprint of battery cells. To catch up with Asia's market leaders, Western manufacturers must work towards achieving cost-effective mass production, for which they need to conduct extensive research and cooperate closely, including with Asian players. These and other findings are presented in the "Battery Monitor 2024/2025", a publication for which Roland Berger and the Chair of Production Engineering of E-Mobility Components (PEM) of RWTH Aachen University analyzed the development of the market, technologies and innovations across the battery industry globally.

"Volatility increased significantly in the battery cell market in 2024," said Wolfgang Bernhart, Partner at Roland Berger. "The main reason for that is the uncertainty around demand: the number of electric cars being sold is growing slower than expected and there are uncertainties over how the regulatory situation will evolve in both the United States and the European Union. Not only does that make it more difficult for manufacturers to plan, it also makes it harder for us to forecast future development."

The study authors therefore modeled three scenarios for how demand might develop. In the market view scenario, based on targets announced by automotive OEMs and assuming rapid progress in electrification, the demand for batteries increases to a capacity of 4.6 terawatt hours (TWh) by 2030 – 0.3 TWh less than forecast in last year's "Battery Monitor" – and rises to 8.8 TWh by 2040. In the base case scenario, factoring in the fulfillment of EU and US emissions targets despite a short-term downturn in electric vehicle sales, demand amounts to 4.3 TWh in 2030 and 8.6 TWh in 2040. In the downside view scenario, incorporating significant delays to regulation, including a delay to the EU's internal combustion engine production ban, demand reaches 4.0 TWh in 2030 and 8.1 TWh in 2040.

EU manufacturers keen to radically reduce the carbon footprint of battery cells

As China is currently producing significantly more batteries than its own market requires, the surplus is being exported. "This is causing prices to plummet globally, but they cannot remain this low long term, because some suppliers and cell producers in China are already not even covering their costs," said Bernhart. But the fall in prices is putting particular pressure on European cell manufacturers, who are working to build up their own capacities so that, in theory, they could cover more than just Europe's demand. Bernhart therefore expects that not all of the announced projects will actually be realized: "Companies outside of China are currently experiencing considerable losses. They were moving forward with production, but now some of them have seen their order volumes drastically reduced, resulting in overcapacity and underutilization in both the EU and the USA. Consequently, the affected companies are now being overcautious in their investment planning, which in turn risks them being undersupplied – an issue exacerbated by delays and problems with industrialization as well as a lack of competitiveness."

European cell manufacturers are focusing predominantly on sustainability in a bid to stand out from their Chinese and US counterparts. They have set themselves the goal of reducing emissions in battery cell production to 30 to 40 kilograms of CO2 per kilowatt hour, which is around a third to a half of the current carbon footprint of battery cells. The study authors consider this a realistic goal, to be achieved primarily by optimizing raw materials procurement, but also through innovations such as dry coating or laser drying, which reduce the energy requirements of significant production processes. "Even though reducing costs is currently more of a priority, producing battery cells with a smaller carbon footprint could give Europe's manufacturers a competitive edge," said Professor Achim Kampker, Head of PEM RWTH Aachen University, "especially given the unlikelihood of European and North American companies ever catching up with China's lead in terms of cost structures and access to raw materials for the same products and technologies."

Many ways to achieve a better competitive position

The analyses conducted by the experts from Roland Berger and PEM RWTH Aachen University revealed a number of levers that the industry can activate to continue to grow successfully and remain competitive. Professor Heiner Heimes, member of the institute management of PEM, cites current and expected advances in cell chemistry as one such lever: "If you base your production plans on innovations early, such as new, cost-effective battery types for small and mid-range electric vehicles, you will be able to transition to mass production faster and benefit from the expected volumes to come." To establish the necessary resilient supply chains, the study authors would advise European manufacturers in particular to work closely with each other – but not only with each other: "Asian manufacturers are streets ahead in terms of research and development, and especially industrialization," said Bernhart. "European players should therefore also consider partnering with leading manufacturers."

Topics

Categories

About Roland Berger

Roland Berger is one of the world's leading strategy consultancies with a wide-ranging service portfolio for all relevant industries and business functions. Founded in 1967, Roland Berger is headquartered in Munich. Renowned for its expertise in transformation, innovation across all industries and performance improvement, the consultancy has set itself the goal of embedding sustainability in all its projects. Roland Berger revenues stood at more than 1 billion euros in 2023.

About the Chair of Production Engineering of E-Mobility Components (PEM) of RWTH Aachen

The Chair of Production Engineering of E-Mobility Components (PEM) of RWTH Aachen was founded in 2014 by StreetScooter co-inventor, Professor Achim Kampker. Working in numerous research groups, the PEM team is dedicated to all aspects of the development, production and recycling of battery systems, electric motors, hydrogen technologies and their respective components as well as their integration, especially in heavy-duty commercial vehicles. A total of 76 academics, 31 non-academics and around 120 student assistants work across three sites. The PEM team is active in teaching as well as in nationally and internationally funded research projects and in cooperation with renowned industry partners. Their focus lies on sustainability and cost reduction at all times – with the aim of creating an unbroken innovation chain from basic research through to mass production. In this context, the chair is a breeding ground for company spin-offs and mobility products, which are sometimes connected.