Press release -

Global automotive supplier study: Market growth in excess of 30% expected by 2030 – fueled by new technologies

- Automotive suppliers are facing substantial shifts – in regional positioning, component growth, and OEM customer structure

- Asian firms are growing alongside local OEMs, securing market share, and increasing the pressure on margins

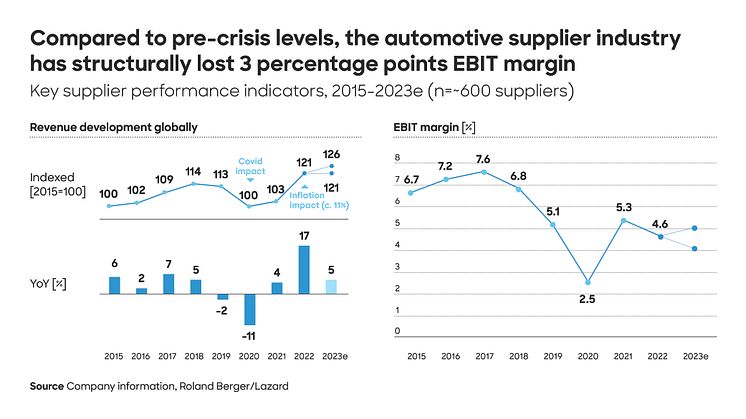

- Traditional suppliers structurally lost 3 percentage points of EBIT margin (down to 4.6%) in 2022, underscoring the urgency for them to boost innovation, flexibility, and international presence

Munich/New York, December 2023: Companies in the automotive supplier industry are divided into two categories. On the one hand, there are new and highly profitable companies focused primarily on batteries, semiconductors, and software. These companies compete with incumbent suppliers while expanding their traditional portfolios beyond industry and consumer goods. The new suppliers are experiencing strong growth in the automotive sector and are achieving very high EBIT margins across all business areas. For instance, while margins in the battery segment were around 10% in 2022, semiconductor suppliers attained an EBIT margin of around 30%, reaching as much as 35% for software providers. On the other side of the equation are traditional automotive suppliers. Their record profits of the last decade are long gone. The new normal for traditional automotive suppliers is EBIT margins of 5% or less (4.6% in 2022). These are the findings of the “Global Automotive Supplier Study 2023”, the latest publication by management consultancy Roland Berger and investment bank Lazard, analyzing 600 automotive suppliers.

"The new competitors, with their innovative hardware and software solutions, perform significantly better in comparison," said Felix Mogge, Partner at Roland Berger. "This is not only due to the product they are selling; it is also because they can react flexibly to market developments and customer requirements, and invest capital in attractive growth segments."

New technologies bring growth

In addition to the new competitors, Asian suppliers are currently among the market winners. They are growing alongside the OEMs from the Far East they supply as local production figures rise. Moreover, they are also benefiting significantly from powertrain electrification and digitalization – technologies that Asian auto manufacturers have been focusing on for some time and that are in greater demand there than in other regions. It is likely that Asian OEMs will gain global market share in the future, pulling their suppliers up with them.

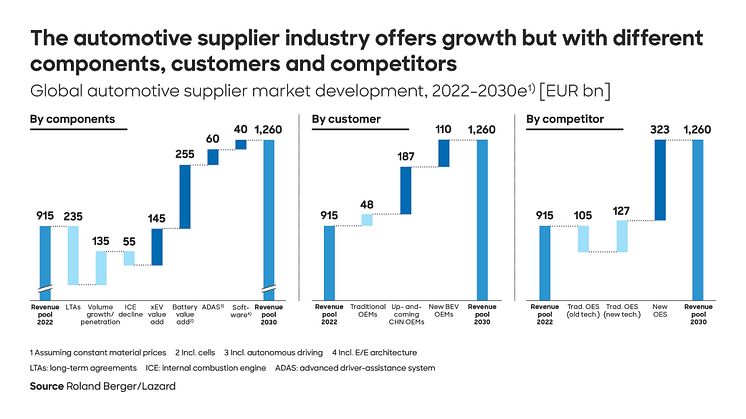

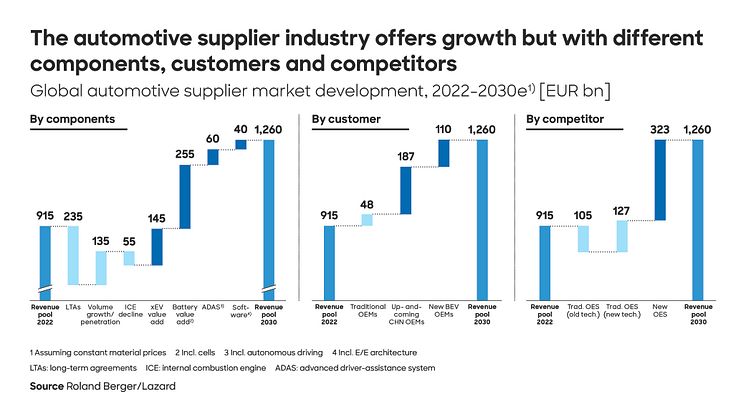

Overall, the automotive supplier market will remain a growth business in the future, but with different components, for different customers and from different suppliers than at present. By 2030, the market size is projected to grow by more than 30%, reaching a total of 1.3 trillion US dollars, corresponding to an annual growth rate of 4%. However, manufacturers of standard mechanical components and combustion engine technologies may lose well over 10% of their current market volume during this period.

"Suppliers from Europe and the USA should increasingly align themselves with the new, fast-growing manufacturers of battery electric vehicles from Asia," said Christian Kames, automotive expert and Co-Head DACH at Lazard Financial Advisory. "Financial strength and scale are becoming increasingly important factors in this global competitive landscape. Therefore, we expect to see an increase in M&A transactions and strategic collaborations."

Three criteria for supplier success – innovation, flexibility and internationality

Particularly, traditional suppliers from Europe and North America are currently not investing enough in fostering the necessary innovations. They are experiencing fluctuating volumes and suffering from a lack of economies of scale in production, high raw material and energy prices, pricing pressure from OEMs, a shortage of skilled labor, and rising interest rates.

However, it is these very investments in innovation that will be crucial to success if companies are to hold their own against Asian industry peers. Automotive suppliers can only adapt their business model to new technologies with the necessary flexibility if they have a global strategy geared toward innovation. "Many suppliers are in need of dedicated performance programs to stabilize margins and protect the business against future uncertainties," said Mogge. "They need to reconsider all their business activities, but specifically their product portfolio, production sites, and supply chain structures."

Topics

Categories

Roland Berger is the only management consultancy of European heritage with a strong international footprint. As an independent firm, solely owned by our Partners, we operate 51 offices in all major markets. Our 3000 employees offer a unique combination of an analytical approach and an empathic attitude. Driven by our values of entrepreneurship, excellence and empathy, we at Roland Berger are convinced that the world needs a new sustainable paradigm that takes the entire value cycle into account. Working in cross-competence teams across all relevant industries and business functions, we provide the best expertise to meet the profound challenges of today and tomorrow.

Lazard, one of the world's preeminent financial advisory and asset management firms, operates in North and South America, Europe, Asia and Australia. Celebrating its 175th year, the firm provides advice on mergers and acquisitions, capital markets and other strategic matters, restructuring and liability management, and asset management services to corporations, partnerships, institutions, governments and individuals. For more information on Lazard, please visit www.lazard.com. Follow Lazard at @Lazard.