Press release -

European EV charging market scaling up to successful business models before 2025

- Rising EV sales are putting pressure on charging infrastructure to scale up fast

- In EV charging four types of business models will prevail

- Around 2025, EV specialists and energy and automotive corporations will start to consolidate the charging market

Munich, September 2022: The European electric vehicle (EV) market is booming, leading the EV charging market to flourish. Competitors within the charging field are testing various business models, strategies and use cases: including charging at home, enroute and at the destination. However, no clear winner has yet emerged. This is set to change. In the study, “EV charging: What will it take to win? Successful business models for a complex market”, Roland Berger experts predict that four types of business models, along the axes of asset intensity and charging speed, will prevail. In each segment, two to three major players will emerge around 2025.

“Today’s EV charging market is highly favorable for companies who seek expansion. While we expect a range of players to remain in the market in the immediate term, we expect consolidation to start by 2025, making the next two to three years critical to success,” explains Baptiste Maisonnier, Partner at Roland Berger. “As we enter a 'survival of the fittest' phase, the winning players will seize the opportunity to scale. They will use the period to raise CAPEX necessary to rapidly and intelligently deploy their charging network and gain presence in key locations, while also following a well-defined roadmap to conquer their target market.”

EV charging market is primed for players to scale

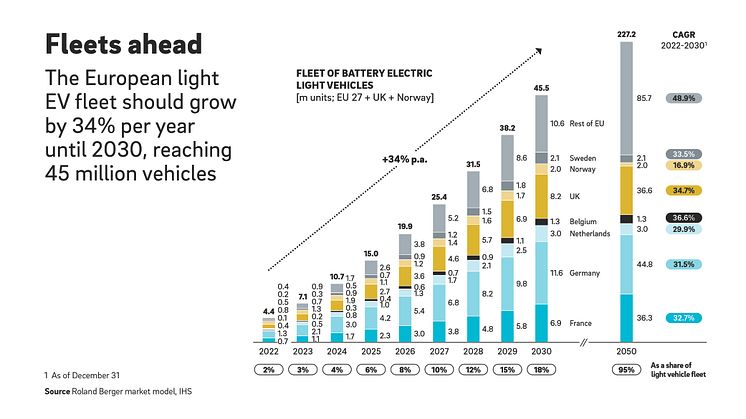

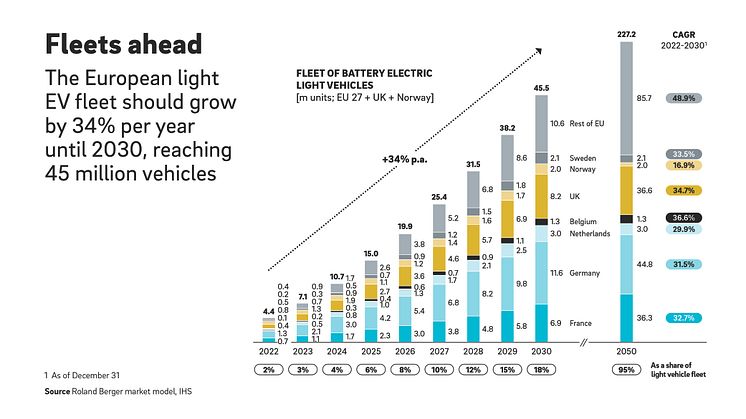

Despite being young, having only been in existence since the 2010s, signs indicate that the EV charging market is already starting to mature, setting the ground for companies wishing to scale. In this endeavor, three factors are contributing to success: strong demand, technological readiness and partnership opportunities. While current demand is already high, with EVs making up only around 2% of the European car fleet (EU27, UK, Norway) nowadays, their market share is expected to jump to 18% by 2030 and 95% by 2050. EV participation in the light vehicle fleet is expected to rise an average of 34% per year, from 4.4 million units in 2022 to 45.5 million in 2030. With that, utilization rates of public charging points are also increasing. High power chargers at airports, for example, have recorded use rates of more than 40%.

The relative newness and agility of EV charging systems contributes to the market’s technological readiness. Additionally, charging firms have already put the necessary CPO/MSP software and interfaces, as well as tested and proven communication protocols, in place. Thirdly, partnership opportunities present engaged industry players the chance to further the innovation of the field through advantageous collaborations. Partnerships with retailers specializing in destination charging, for example, offer EV charging companies a way to generate additional revenue, while service partnerships secure the necessary hardware and software from OEMs and IT companies.

Four market segments pave the way for success

“As the EV charging market grows, we see four segments emerging,” says Tim Longstaff, Partner at Roland Berger. “These can be plotted along two different axes: CAPEX risk levels (asset light and asset heavy) and charging speed (slow charging and rapid charging).” Asset heavy players take on the most CAPEX risk by investing CAPEX directly and assuming the threat of empty stations. Asset light players, on the other hand, risk less and provide services, such as sourcing, location selection and maintenance, but face the challenge of finding business alternatives when charger installation slows. The axis representing charging speed is dependent on location. Slow charging is used in residential and workplace contexts, while rapid charging is largely used in pointed destination or enroute applications.

The segments of these axes are divided as such: Asset heavy/rapid charging; asset light/rapid charging; asset heavy/slow charging; and asset light/slow charging. As the market matures, Roland Berger experts expect to see two to three major players in each segment capitalizing on varying opportunities. Players engaging in the “asset heavy/rapid charging” segment, for example, will benefit most from locations with high utilization rates, such as highways. Those in “asset light/rapid charging,” will need to establish strong commercial partnerships in attractive and frequently visited locations, such as malls, restaurants and hotels.

Although vast opportunity awaits, players wishing to dominate in the EV charging market must act fast, adopt the right strategies and scale now, to come out on the right side of the oncoming consolidation.

Topics

Categories

Roland Berger is the only strategy consultancy of European origin with a strong international presence. As an independent firm owned exclusively by our partners, we have 51 offices with a presence in all major markets. Our 2,700 employees are characterized by a unique combination of analytical thinking and an empathetic mindset. Driven by our values of entrepreneurial spirit, excellence, and empathy, we are convinced that business and society need a new, sustainable paradigm that focuses on the whole value-creation cycle. By working in interdisciplinary teams across all relevant sectors and business functions, Roland Berger offers the best expertise worldwide for successfully overcoming the profound challenges of our age now and in the future.