Press release -

Connected White Goods Will Be the New Standard by 2022 – Uncharted Territory for Many Mid-Sized Manufacturers

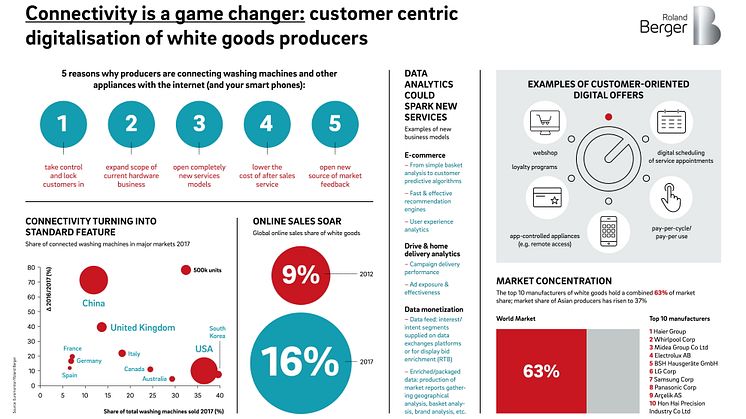

Munich, April 2018: The domestic appliances market is rapidly consolidating, with the top ten MDA suppliers dominating almost two-thirds of the global market. While incumbents operating in saturated markets see their margins falling, Asian producers have been able to significantly expand their position worldwide. This represents a critical challenge especially for mid-sized players, whose R&D budgets are limited. Appliance connectivity and end customer marketing will be crucial to the success of companies in the coming years, according to a recent analysis by Roland Berger.

"In the domestic appliances context, connectivity is more than just another feature for customers," says Justus Lorentz, Partner at Roland Berger. "It is a key lever to retain control over customer access, develop new business models and generate recurring cash flows."

Majority of new white goods will be connected by 2022

Connectivity via smartphone, tablet or computer will be a standard feature of new domestic appliances from 2022 onward. Connected white goods currently command a price premium of 15 percent over non-connected appliances. Aside from technological innovations such as the possibility to control household appliances on the go, connectivity enables several new business models – including pay-per-cycle instead of the pay-to-purchase model. This means that we could eventually see people paying for the number of washes they completed with their washing machine instead of buying the machine itself.

White goods suppliers striving to gain new and lock in existing customers can reap major advantages from connectivity. For example, customers can be equipped with better information about the installation or efficient usage of their appliances. White goods can be serviced easier in the event of any problems and the necessary spare parts supplied quicker. "It's not only end customers that benefit from being able to get their problems solved faster – manufacturers also profit," explains Lorentz. "The purchase, use and repair of domestic appliances yield important data that can produce in-depth customer insights and lead to targeted product and service offerings. That is a crucial way for manufacturers to stay relevant in this fiercely competitive market."

Major market consolidation – data are a key success factor

Roland Berger's analysis shows that the global market for white goods faces considerable consolidation pressure: the top ten suppliers currently account for 63 percent of the global market. Asian manufacturers not only benefit from acquisitions and strong growth in their local markets but are also market leaders in product innovation.

This makes a new marketing and sales approach even more imperative: "MDA suppliers need to widen their focus beyond retailers as their main sales channel and start professionally marketing their products to the end customer, like car manufacturers or the multimedia industry," advises Roland Berger Partner Justus Lorentz.

Though many manufacturers have long had access to data on the behavior and preferences of their customers through aftersales contacts, most are entering uncharted territory when it comes to using this data for more reliable sales forecasts, better customer segmentation and more targeted marketing campaigns. Addressing customers directly through digital channels is another potential area for action and improved access to customers – a key success factor for white goods suppliers both small and large.

Roland Berger, founded in 1967, is the only leading global consultancy of German heritage and European origin. With 2,400 employees working from 35 countries, we have successful operations in all major international markets. Our 52 offices are located in the key global business hubs. The consultancy is an independent partnership owned exclusively by 230 Partners.