Press release -

Aerospace industry: Signs of supply chain stabilization are evident, but investment support remains key to sustaining the ramp-up

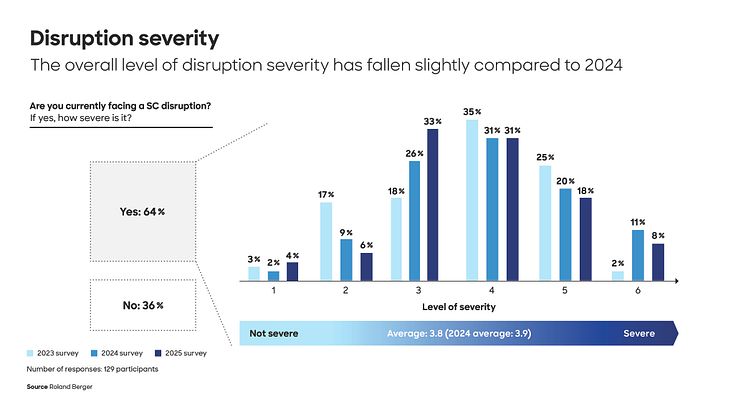

- Despite signs of stabilization, two out of three surveyed companies continue to experience supply chain disruptions

- Improving resilience is crucial as tariffs, trade wars and cyberattacks create new challenges

- Targeted financial support is key for half of suppliers to expand capacity

Munich, July 2025: After years of severe disruptions within the supply chain, the global aerospace industry is finally showing signs of stabilization. The latest Aerospace Supply Chain Resilience Report 2025, published by Roland Berger in cooperation with BDLI (Germany), GIFAS (France) and ADS (UK), highlights encouraging signs of supply chain stabilization across the sector. Based on a survey of 130 small to medium-sized suppliers active in the civil and military aerospace domains, the report reveals a cautiously optimistic picture: nearly 70% of respondents feel well or very well prepared for the upcoming production rate ramp-up. However, it might take until next year before this results in a noticeable ramp-up in production rates because of the long lead times across the supply chain. Half of suppliers currently require more financial resources to adjust their capacity (materials, personnel, working capital) to match the OEMs' planned production rate ramp-up.

While two-thirds of companies that took part in the survey are still experiencing supply chain disruptions, the level of very severe disruption has fallen from the heights to which it had risen between 2023 and 2024. The most severe disruptions remain concentrated at Tier-1 and Tier-3+ levels. The stabilization now observed is creating favorable conditions for production acceleration, expected to materialize from next year onward due to the long lead times inherent to the sector. Overall, the industry is seeing a positive trend compared to previous years: Almost 70% of companies now believe they are either well prepared or very well prepared for a production rate ramp-up. This is a significant improvement on 2024, when only 35% of study participants were optimistic about their preparedness.

"The industry is gradually working its way out of crisis mode," said Stephan Baur, Partner at Roland Berger. "However, the road ahead is not without challenges: shortage of skilled workers, limited production capacities and growing financial shortfalls. But we are seeing an improvement in resilience and preparedness."

A key focus of the report is the financial health of the lower tiers of the supply chain. Half of the surveyed companies indicate a need for additional financial resourcesto ramp up their production capacity and invest in R&D as needed, or to hire additional personnel they urgently require. Tier-2 and Tier-3+ suppliers are particularly affected. Limited access to capital, exacerbated by cautious banking practices, remains a major challenge. Many banks have reduced the amount of capital they will make available to smaller suppliers due to their low equity ratios and margins, and some have even stopped lending to them altogether.

Despite these hurdles, the report underscores that many suppliers are ready to move forward, provided they receive targeted support. The authors stress that addressing financial constraints at the lower levels of the chain is essential to ensure the industry's recovery momentum is sustained. Failing to do this would prevent OEMs from ramping up their production rate as planned in the coming years. Moreover, smaller suppliers are coming under added pressure from geopolitical instability and innovation barriers.

"The supply chain requires much more stable ramp-up planning and demand signals as well as further financial support from external institutes," said Dr. Jörg Schuler, CEO Diehl Aviation and VP Equipment and Materials at BDLI.

Four measures to future-proof supply chain resilience

Despite the industry being on the right track and the supply crunch having eased, the study authors believe that further measures are still required in four areas to secure supply chains long term:

- Industry-wide knowledge transfer: Systematic sharing of best practices along the supply chain to strengthen operational excellence, sustainability and cybersecurity. This can be done via the AeroExcellence International Initiative of the BDLI, GIFAS and ADS.

- Stable and transparent demand planning: Closer collaboration between OEMs and suppliers for optimal alignment on production and procurement planning.

- Establish a sustainable financing structure for Tier-2 and Tier-3+ suppliers: Various financing options should be provided by OEMs (long-term offtake agreements, co-investments and equity investments), banks (special private debt funds) and government support programs (government guarantees, loan guarantees, investment subsidies). Independent of such support, suppliers could also strengthen their financial position by partnering with OEMs or other suppliers.

- Strengthen risk management: More professional monitoring and control of risk through systematic analysis of critical supply chain risk exposure, identifying geopolitical and other risks at an early stage and enabling successful countermeasures to be put in place.

"To address rate ramp-up, the Net Zero imperative and geopolitical uncertainty, significant capital is crucial. Without collaboration, small and medium-sized suppliers will face financing bottlenecks," said Balaji Srimoolanathan, ADS Director for Aerospace, Space and the Aerospace Growth Partnership.

Topics

Categories

Roland Berger is one of the world's leading strategy consultancies with a wide-ranging service portfolio for all relevant industries and business functions. Founded in 1967, Roland Berger is headquartered in Munich. Renowned for its expertise in transformation, innovation across all industries and performance improvement, the consultancy has set itself the goal of embedding sustainability in all its projects. Roland Berger generated revenues of around 1 billion euros in 2024.