Press release -

A sustained boom: Global battery market continues on a growth trajectory

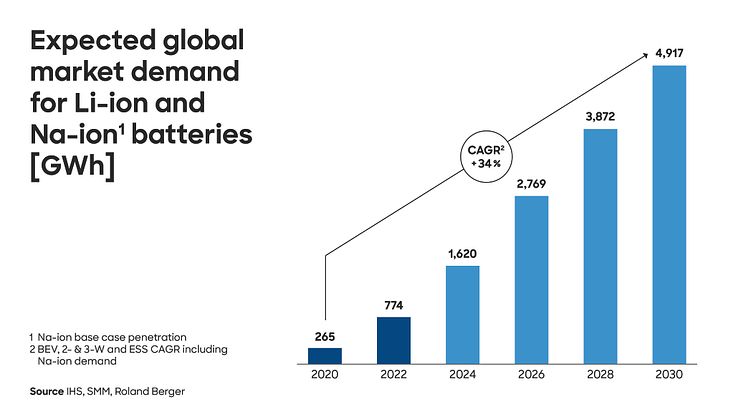

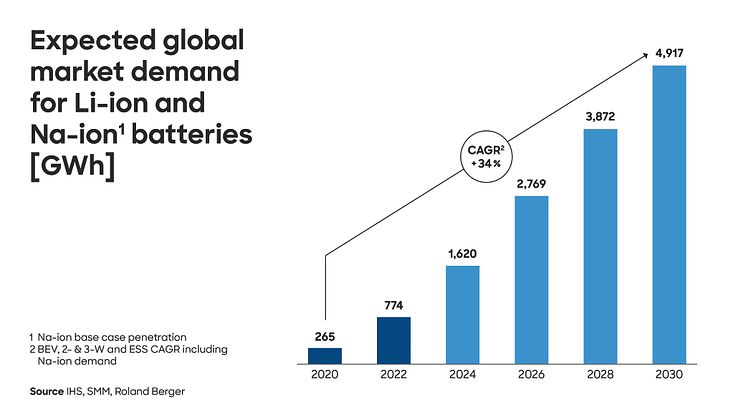

- Global battery market set to grow at 34% per year until 2030

- Electric vehicles will account for around 80% of demand for lithium-ion batteries over the coming decades

- Competition is growing from new European and US manufacturers as well as massively expanding Chinese companies

Munich/Aachen, December 2023: Despite the recent deceleration in automotive manufacturers' electric vehicle projections, the global battery market continues to grow at an enormously fast pace and the demand for lithium-ion and sodium-ion batteries is still rising. Between 2020 and 2030 alone, demand will increase more than eighteenfold at an annual growth rate of 34%. The main reason behind this development is the automotive industry's switch to battery electric vehicles. This is having a corresponding impact on the industrial landscape, particularly in the USA and Europe. New battery production hotspots are emerging in these regions, as well as new companies to add to those already existing in Asia. These are among the conclusions reached by Roland Berger and the Chair of Production Engineering of E-Mobility Components (PEM) of RWTH Aachen University in their "Battery Monitor 2023" publication, which provides a comprehensive market overview of the global battery industry.

The focus of current developments lies primarily on technical innovations towards more efficient production and alternative battery materials. "To thrive on the international market, battery manufacturers need to optimize their production processes. Developing new production technologies is the key to efficient, cost-effective and sustainable battery production," says Professor Heiner Heimes, Member of the Institute Management of RWTH's Chair of PEM.

A fiercely competitive international growth market

Demand for batteries is expected to reach around 4,900 gigawatt hours (GWh) in 2030, significantly up on last year's forecast of about 4,000 GWh. Yet this expected demand will be exceeded by announced global production capacities of around 8,900 GWh in 2030. However, it is doubtful whether these capacities will all be realized. "We do not expect to see overcapacity outside China," says Wolfgang Bernhart, Partner at Roland Berger. "The lack of materials, available talent and secured sales is impairing the performance of battery manufacturers and production processes worldwide."

Furthermore, market imbalances are arising – exacerbated by national legislation. The development of production capacities and requirements differs starkly between countries, particularly the USA, China and Europe. "In North America, we will see new relevant market players emerging. In Europe, large amounts of battery capacity have been announced, but many of the companies are still very new, so we expect the market to consolidate," says Bernhart. "China, on the other hand, is building up tremendous overcapacities. Low capacity utilization is the result, alongside export pressure."

However, goods from China are unlikely to be imported into the USA: International trade is hampered by the sizeable tax hit of 25.4% on battery imports from China and the barriers Chinese manufacturers and suppliers face as a result of the Inflation Reduction Act. That is why Chinese manufacturers are increasingly focusing on the European market, which in turn increases the cost pressure on local producers.

Sustainable production and innovations pave the way

Innovative product and process technologies have become increasingly important in the battery sector in recent years to counteract the years of experience that Asian factories already have. As a result, there is a growing trend in patents coming out of the USA and Europe. These innovations are particularly relevant in production technologies. Companies must strike a balance between efficient, cost-effective and sustainable battery production. In the medium-term future, this will be the only way for firms to secure their position in this dynamic market.

Topics

Categories

Roland Berger

Roland Berger is the only management consultancy of European heritage with a strong international footprint. As an independent firm, solely owned by our Partners, we operate 51 offices in all major markets. Our 3000 employees offer a unique combination of an analytical approach and an empathic attitude. Driven by our values of entrepreneurship, excellence and empathy, we at Roland Berger are convinced that the world needs a new sustainable paradigm that takes the entire value cycle into account. Working in cross-competence teams across all relevant industries and business functions, we provide the best expertise to meet the profound challenges of today and tomorrow.

Production Engineering of E-Mobility Components (PEM) of RWTH Aachen University

The Chair of Production Engineering of E-Mobility Components (PEM) of RWTH Aachen University was founded in 2014 by StreetScooter co-inventor Professor Achim Kampker, who, in addition to his expertise in electric mobility components and concepts in teaching and research, also has many years of experience in the management of start-ups and established companies. In ten research groups, the PEM team is dedicated to all aspects of the development, production, and recycling of battery systems and their components as well as fuel cells and the production of the electric drive train and entire vehicle concepts. PEM employs a total of 78 researchers, 35 non-scientific staff and around 130 student assistants. The team is active in teaching as well as in nationally and internationally funded research projects and collaborates with numerous renowned industrial partners. The focus is always on sustainability and cost reduction – with the aim of a seamless ‘Innovation Chain’ from basic research to large-scale production in the immediate vicinity. PEM provides the breeding ground for partially networked spin-offs such as PEM Motion and mobility products such as Velocity Aachen.