Press release -

The tough times continue for automotive suppliers – 2022/2023 production volumes remain below pre-pandemic levels

- Inflation, chip shortages and rising material and energy costs represent a significant setback for the industry

- Electronics (9.4 percent average EBIT margin) and aftermarket (10.5 percent) are the most profitable segments – traditional and small suppliers hit hardest by margin pressure

- Interest rate rises on the back of inflation make refinancing more expensive and thus throttle future-proofing investments

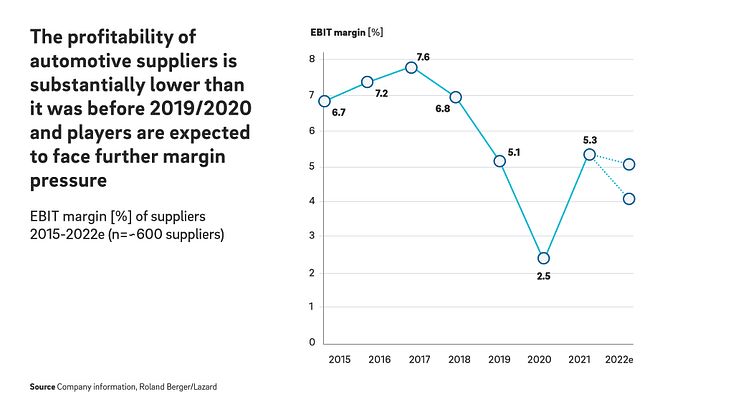

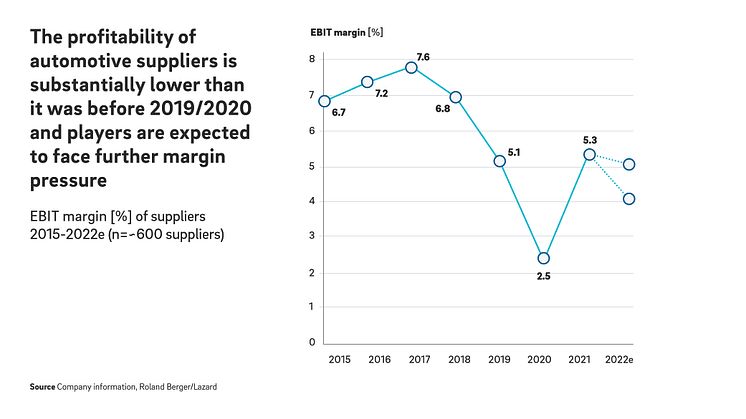

Munich/Frankfurt, Dezember 2022: Automotive suppliers must continue to expect challenging times ahead – despite the industry already being under enormous pressure to transform. Although the average profit margin in 2021 returned to pre-pandemic levels at 5.3 percent, the war in Ukraine, semiconductor shortages and rising material and energy prices brought the recovery to an abrupt halt in 2022. Adjusted for inflation, global revenues in the supplier industry will be back below 2019 levels over the next twelve months. The challenging interest rate environment is also hampering necessary investments in future technologies for the sector. These are the key findings of the “Global Automotive Supplier Study 2022” for which Lazard and Roland Berger analyzed the performance indicators of around 600 suppliers.

"For three successive years now, the automotive supply industry has been struggling with lower production volumes than before the pandemic, and there are few signs of the situation resolving fully. A return to pre-crisis levels is not expected until after 2025," says Felix Mogge, Partner at Roland Berger. "That said, there is major variation in the profitability of the different segments. Electronics suppliers and those automotive suppliers that serve the aftermarket have outperformed the industry's average profitability by far, whereas most of the traditional component suppliers face a further decline in their margins in this market. In particular, small suppliers that lack strong regional positioning and broad product diversification are likely to be the slowest to recover."

Margins remain under significant pressure for most suppliers

The Covid pandemic and subsequent crises have set the supplier industry back five years to 2017/18 levels in terms of revenue growth. Weak production volumes, especially in Europe, have led to structural underutilization of supplier capacity.

Since as far back as 2019, OEMs and suppliers have seen their margins going in opposite directions on the back of structural constraints. The effect was further amplified in 2021 and 2022 when most suppliers were unable to pass through the rising costs of energy and logistics and the chip shortage to a sufficient degree. Suppliers' margins will therefore fall back in 2022 to below 2021 figures (5.3 percent on average) – and no fundamental improvement can be expected in 2023 against the backdrop of the overall economic situation. However, there are major differences between the different subsegments. In 2021, electronics suppliers (9.4 percent average EBIT margin) and those serving the aftermarket segment (10.5 percent) benefited the most. Exterior component suppliers found themselves under the most pressure (4.3 percent) owing to standardization and rising raw material costs.

Looking at company size, mega-suppliers with revenues in excess of EUR 10 billion were still the most profitable, with an EBIT margin of 5.9 percent in 2021. Smaller businesses with revenues below EUR 500 million were only able to achieve low margins averaging 2.8 percent. However, also the earnings of many large suppliers will come under added pressure in 2022 due to increases in factor costs. Finding ways to overcome this challenge jointly with the OEMs will likely continue to dominate the suppliers' agenda in 2023.

Higher refinancing costs are a very real risk

"Interest rate rises in times of high inflation will make future refinancing options much more expensive for automotive suppliers. Combined with the fluctuating production volume and a potential downgrade of their own rating, this is a substantial risk for suppliers," says Christof Söndermann, Managing Director at Lazard. "We do not expect the borrowing climate to improve in the next twelve to 18 months. Several automotive suppliers have been downgraded from investment grade to non-investment grade since 2019. This is a critical development as the capital required to fund a response to the industrial challenges is significant and the access to equity is limited for incumbent automotive suppliers."

The automotive industry's transformation towards electric and autonomous driving, with ever more digitalized vehicle functions and mobility offerings, is also leaving suppliers with no choice but to invest in new technologies. The study's authors concluded that revenue and profit growth can only be achieved in the coming years in combination with new technologies. This is because, while electric drive technology made up only 4 percent of the components market in 2019, it will account for 25 percent of the market by 2030.

Topics

Roland Berger

Roland Berger is the only strategy consultancy of European origin with a strong international presence. As an independent firm owned exclusively by our partners, we have 51 offices with a presence in all major markets. Our 3,000 employees are characterized by a unique combination of analytical thinking and an empathetic mindset. Driven by our values of entrepreneurial spirit, excellence, and empathy, we are convinced that business and society need a new, sustainable paradigm that focuses on the whole value-creation cycle. By working in interdisciplinary teams across all relevant sectors and business functions, Roland Berger offers the best expertise worldwide for successfully overcoming the profound challenges of our age now and in the future.

Lazard

Lazard, one of the world's preeminent financial advisory and asset management firms, operates from 41 cities across 26 countries in North, Central and South America, Europe, Asia and Australia. With origins dating to 1848, the firm provides advice on mergers and acquisitions, strategic matters, restructuring and capital structure, capital raising and corporate finance, as well as asset management services to corporations, partnerships, institutions, governments and individuals. For more information on Lazard, please visit www.lazard.com. Follow Lazard at @Lazard.