Press release -

Study on long-distance mobility: 90% of respondents willing to pay 20% more to limit climate impact of flights

- Rise in travel activity owing to catch-up demand in the USA and Europe; significant drop in China due to Covid restrictions

- Growing environmental concerns limit people's willingness to travel long distance

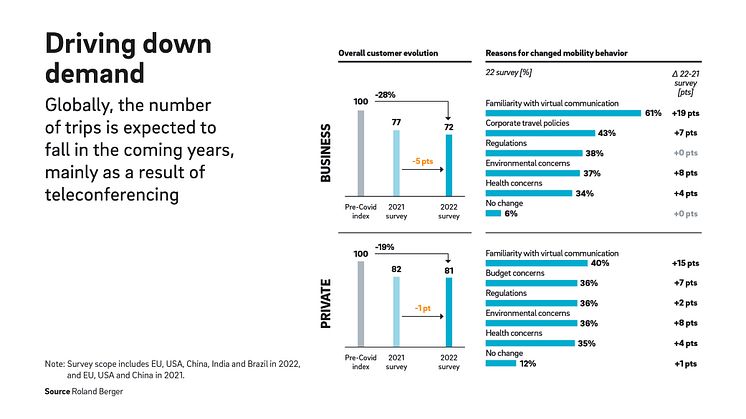

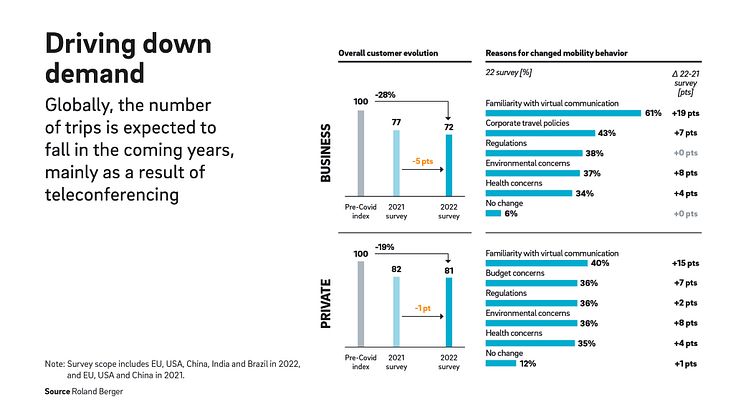

- Consumers are planning 28% less business travel and 19% less private travel

Munich, February 2023: Demand for long-haul travel has bounced back markedly over the past year and a half but remains below pre-pandemic levels. Full recovery is not expected in 2023 either. These are among the findings of the Roland Berger study "Destination unknown: The future of long-distance travel". While significantly more people are traveling again, mainly due to catch-up demand, the number of respondents who say they plan to travel less in the future is higher than it was in 2021. Alongside the increased use of virtual communication, environmental concerns are also increasingly named as a reason. The study is based on market analyses and a large-scale survey that the experts conducted with around 7,000 consumers across seven countries.

"The easing of Covid travel restrictions has given a major boost to air and rail travel globally over the past 18 months," says Jan-Philipp Hasenberg, Partner at Roland Berger. "Yet, demand in key markets is still below pre-pandemic levels. Then there are other factors like rising energy and fuel prices as well as the labor shortage that are putting pressure on travel operators to make their operations more efficient."

Increase in travel due to catch-up effect

Compared with the findings of the previous study dating from 2021 and a pre-Covid index from 2019, there have been distinct changes in long-distance travel behavior. In the US, demand for flights rose to 87% of pre-Covid levels in the first half of 2022, 18 points higher than in 2021. Air travel in Europe also recovered in spite of the Ukraine war and multiple economic challenges: Demand was already back at 60 to 80% of pre-pandemic levels in the first half of 2022, having been at 20 to 40% in 2021. Similarly, European rail traffic rebounded to reach about 75% of pre-Covid levels. In China, on the other hand, due to Covid restrictions, demand for air travel was just 32% of pre-Covid levels in the first half of 2022, down from 74% in 2021. Demand for rail travel also fell 37% from 2021 to 2022.

Consumer attitudes more critical towards long-distance travel

Overall demand for long-haul travel is expected to remain below pre-Covid levels in the coming year. This is the conclusion reached by the study authors after their global consumer survey. Across all focus markets, respondents are planning to travel significantly less than before the pandemic. The number of anticipated business trips, for example, was 28% lower than in 2019, and was even five points lower than it had been in the 2021 survey. The number of private trips planned was 19% down (2021: 18%). A reluctance among consumers to travel long distance is particularly striking, with the number of planned intercontinental business trips falling to 42% of pre-Covid levels, 22 points down on 2021.

The main reason for the change in mobility behavior is the increased use of virtual communication, this being cited as a factor for both business travel (mentioned by 61% of respondents) and private travel (40%). For business travel, the next biggest reasons are changes in corporate travel policies (43%), new legal regulations (38%) and, for increasing numbers of people, environmental reasons (37%, up 8 points on 2021). In the case of private travel, legal regulations, budget concerns and environmental reasons all rank joint second, at 36% each.

"The importance to the survey respondents of protecting the environment and the climate factor is made clear by two key findings: First, the majority of people plan to limit the amount of air travel they do in favor of traveling by rail or car. Second, at 90%, almost all respondents are willing to pay 20% more for a flight ticket if it helps decarbonization efforts, says Hasenberg. “Accordingly, the top topic for many firms at the moment is to expand their product range to include 'green products' with correspondingly adjusted prices."

Topics

Categories

Roland Berger is the only management consultancy of European heritage with a strong international footprint. As an independent firm, solely owned by our Partners, we operate 51 offices in all major markets. Our 3000 employees offer a unique combination of an analytical approach and an empathic attitude. Driven by our values of entrepreneurship, excellence and empathy, we at Roland Berger are convinced that the world needs a new sustainable paradigm that takes the entire value cycle into account. Working in cross-competence teams across all relevant industries and business functions, we provide the best expertise to meet the profound challenges of today and tomorrow.