Press release -

Strategy shift among MedTech companies: Revenue growth replaces profit optimization as top priority

- The MedTech industry's traditionally high margins have fallen sharply in recent years – a new strategy is required

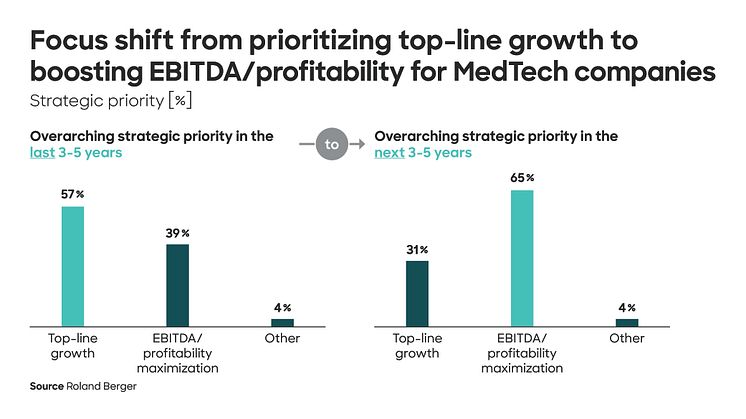

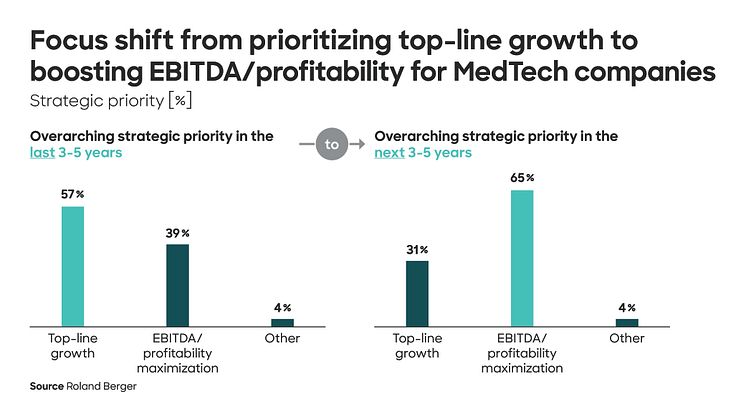

- The number of companies focusing on revenues has halved – two-thirds now concentrate on maximizing profits instead

- To increase profitability, MedTech companies focus predominantly on optimizing sales, sourcing/procurement and the supply chain

Munich, April 2024: With profitability in decline, companies in the medical technology sector are changing their strategic priorities: While 57% of MedTech firms had been prioritizing top-line growth over the past three to five years, this figure has almost halved recently, to 31%. By contrast, 65% of companies now plan to focus their strategy on optimizing profitability in the upcoming years. Essentially, MedTechs seek to get back to their core business by streamlining the product portfolio and concentrating on core markets. Companies are not necessarily prioritizing the levers with the highest potential return on revenues and are taking additional factors into account: Sales, sourcing/procurement and the supply chain are the main focus for performance improvements, even though areas like research & development and support/aftersales have greater potential for higher margins. These are the key findings of the study "Future of MedTech 2024", for which the Roland Berger experts surveyed 600 industry executives.

"Up to now, MedTech players focused mainly on growth strategies – for instance launching new products and/or entering new markets – where historically high margins could be achieved compared to the industry as a whole," said Peter Magunia, Partner at Roland Berger. "But profitability has seen a significant drop in recent years, as our previous MedTech study highlighted last year. The reason for this is the difficult macroeconomic environment that companies faced, and indeed continue to face now, with rampant inflation, rising interest rates and numerous geopolitical uncertainties. This year's study shows that companies are reacting by changing their strategy and increasingly focusing on boosting profitability."

This shift in strategic priorities is particularly pronounced among companies running on lower profit margins (up to 15%): While 48% of these firms still focused on growing revenues in the past three to five years, only 20% plan to do the same in the future. Instead, 72% intend to focus their strategy on maximizing profitability (previously 44%). Among companies with higher margins (above 15%), 42% still prioritize revenues (previously 65%), but here too, a majority of 58% (previously 35%) now focus on profitability.

Prioritized levers are not always the ones with the highest optimization potential

The companies in the survey plan to maximize profits primarily by concentrating on their core business. "The preferred strategy is to streamline the product portfolio and focus on core markets," said Peter Magunia. "This is also a good way for MedTechs to deal with the growing complexity resulting from regulatory demands like ESG requirements or the EU's new Medical Device Regulation, alongside supply chain challenges." To increase profitability in their core markets, companies are focusing primarily on technology and digitalization, such as AI and machine learning to manage supply chains, or robotic process automation in production.

Nevertheless, the survey highlights a clear imbalance between the levers that companies are prioritizing to improve performance and the potential contribution that these levers can make to profit maximization. Respondents cited sales, sourcing/procurement and the supply chain as the most important areas for profitability-boosting initiatives. While the high priority afforded to sales does match its high margin improvement potential of 5.0 percentage points, sourcing/procurement and supply chain offer the lowest potential of all the areas in the survey, at 2.9 and 2.7 percentage points, respectively. Research & development, at 6.3 percentage points, and support/aftersales, at 5.7 percentage points, have the potential to make the greatest contribution to boosting profitability – but these are low down on companies' list of priorities, in fifth and seventh (last) place, respectively.

"Factors like the risks and the probability of realizing the improvements have a role to play in this imbalance between the prioritization and the potential of the different value chain areas," said Thilo Kaltenbach, Partner at Roland Berger. "Naturally, these factors need to be taken into account. It is important for each company to identify which areas and which levers are relevant for them individually, and to precisely plan how to apply them. A variety of tools and instruments can then be implemented to maximize profits and boost growth. If you invest in the right technologies and use them correctly, you have the opportunity to increase your company's productivity and stay one step ahead of the competition."

Categories

Roland Berger is one of the world's leading strategy consultancies with a wide-ranging service portfolio for all relevant industries and business functions. Founded in 1967, Roland Berger is headquartered in Munich. Renowned for its expertise in transformation, innovation across all industries and performance improvement, the consultancy has set itself the goal of embedding sustainability in all its projects. Roland Berger revenues stood at more than 1 billion euros in 2023.