Press release -

Roland Berger study: Nearly half of consumers surveyed in Germany, the UK and France plan to do more of their shopping through quick commerce

- Q-commerce promises delivery within 30 minutes of placing an order online

- Market potential in grocery retail amounts to around 2% of the total market – equivalent to some EUR 13 billion in the period to 2030

- Pharmaceuticals forecast to see the biggest growth opportunities

Munich, December 2022: Consumer interest in the fast delivery of everyday goods through q-commerce services is very high, even in today's difficult macroeconomic situation. Purchases of pharmaceuticals, groceries and drugstore items are seeing volumes rise particularly strongly. These are the findings of the study "Quick commerce – a lasting revolution? How omnichannel retailers are rising to the challenges of q-commerce" by Roland Berger, which polled the opinions of more than 6,000 consumers from Germany, the UK and France. The publication offers insights into the lasting impact that q-commerce will have on the retail industry.

"It is tempting to see quick commerce as just another increase in service levels – a natural progression to even faster deliveries. But in fact, q-commerce is an entirely new channel, with its own unique business model. It primarily targets spontaneous, time-sensitive or emotional purchases," says Thorsten de Boer, Partner at Roland Berger. "Q-commerce focuses on fast-moving consumer goods with high margins. This form of shopping is not going to replace traditional online retail – instead it will complement and even boost it."

Quick commerce is creating previously unmet demand

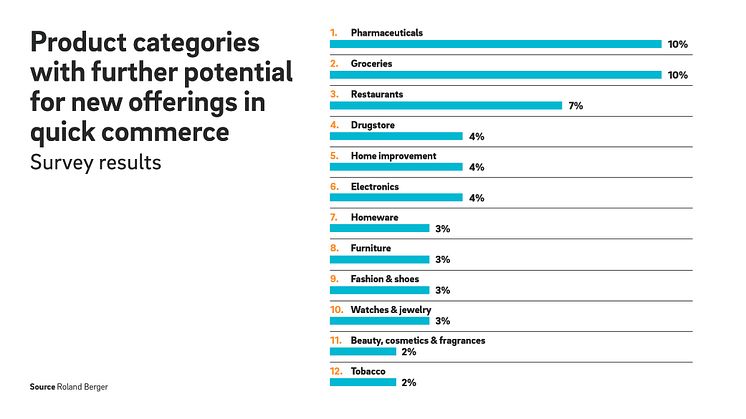

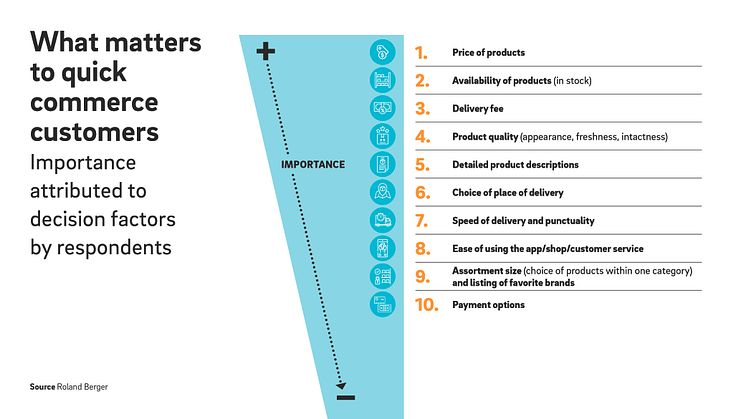

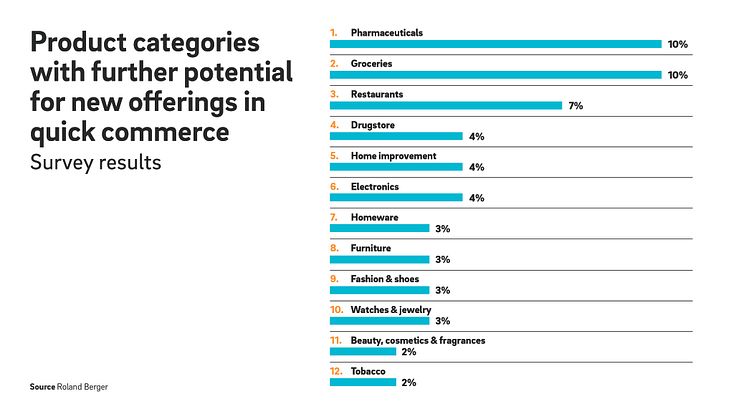

Q-commerce is fast becoming the new benchmark for rapid delivery, especially in urban centers. 46% of those polled plan to shift more of their shopping to q-commerce in the future. According to the survey, the top five product categories for this form of consumption are: pharmaceuticals (10%), groceries (10%), restaurant (7%), drugstore (4%) and electronics (4%). Survey participants say that the key decision factors are first and foremost the price and availability of products, followed by the delivery fee.

40 to 47% of respondents (depending on product category) state that the selection of products available through q-commerce is still too limited and that many of their preferred brands are not offered. That said, the study found that customers are not prepared to pay more for a wider range of products, nor are they willing to pay extra for delivery. The authors therefore expect delivery times to go up in the longer term, settling at between 30 and 60 minutes in total.

For spontaneous and urgently needed purchases, q-commerce is the consumers' first choice, selected by 27% of survey respondents in total. But when it comes to longer-term planned or recurring purchases such as the weekly grocery shopping, delivery the next day or even two to three days later is fast enough for 27% of those polled.

A fiercely competitive market of the future with consolidation imminent

Q-commerce players are operating in a highly competitive market. Whether or not the amount they will be able to earn from product margins, commission and service fees as well as in-app advertising is enough to cover their operating costs and turn q-commerce into a lucrative business model remains unclear at this time. Product prices in q-commerce are currently similar to those in supermarkets, while marketing for brand building can account for up to 30% of total costs in the early stages and delivery fees rarely cover the actual costs.

"Only the most efficient q-commerce players will survive the upcoming market consolidation. However, the subsequent stabilization phase will have a lasting impact on the retail industry. Multichannel retail players should start adapting their offerings now and expand their digital business models," says de Boer.

Multichannel retailers looking to enter the q-commerce market have two options at their disposal. They can either partner with an existing provider or build their own capabilities. The study's authors believe that the partnership model will come out on top. The advantages it offers include the chance to participate in the established structures of leading platforms and profit from their know-how; comparatively low initial investment and shared running costs; and greater profitability on a per-unit basis owing to economies of scale. On the other hand, one argument that speaks in favor of retailers creating their own q-commerce capability is the fact that doing so will keep them in control of the consumer interface. This is, however, offset by the large CAPEX investments involved in building up the retailer's own platform, inventory, and warehouse and delivery logistics. For distribution in Germany, for example, a q-commerce retailer would need 11 well-placed warehouses across the country, each carrying an identical product range that can be shipped out within two hours of an order being placed. A further 30 stores in major cities would be needed just to provide same-day delivery to half the population.

Topics

Categories

Roland Berger is the only management consultancy of European heritage with a strong international footprint. As an independent firm, solely owned by our Partners, we operate 51 offices in all major markets. Our 3000 employees offer a unique combination of an analytical approach and an empathic attitude. Driven by our values of entrepreneurship, excellence and empathy, we at Roland Berger are convinced that the world needs a new sustainable paradigm that takes the entire value cycle into account. Working in cross-competence teams across all relevant industries and business functions, we provide the best expertise to meet the profound challenges of today and tomorrow.