Press release -

Roland Berger study: Medical technology industry sees margins shrink

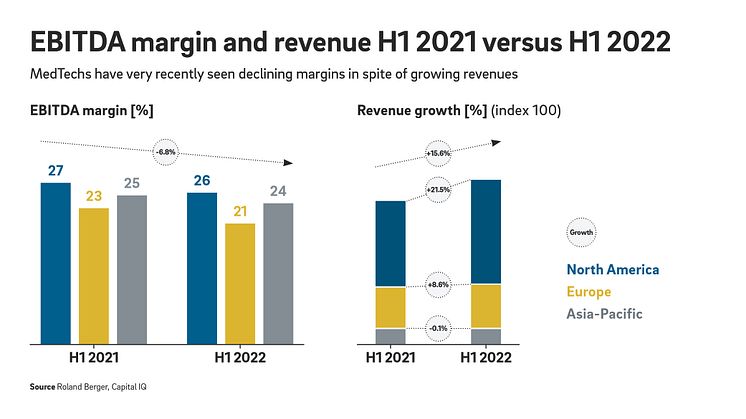

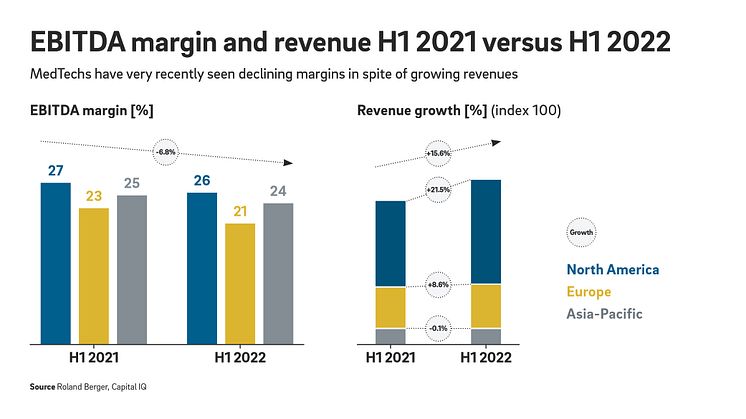

- Profit margins for MedTech companies fell by 6.8% on average in the first half of 2022

- North American companies with strongest performance

- Six structural challenges are key to future success

Munich, November 2022: In recent years, the MedTech industry treated investors to high returns and outperformed other industries by a long way. However, the industry is now starting to feel the impact of high energy costs, rising inflation and supply chain problems. Despite revenues growing (up 15.6%) in the first half of 2022 compared to the first six months of last year, profit margins have fallen over the same period (down 6.8%). This is one of the findings of the new Roland Berger study “Global MedTech – How to succeed in uncertain times”. The authors analyzed data from more than 100 companies for the publication.

"Despite its previous success, the MedTech industry is not immune from the economic turbulence buffeting businesses today," says Thilo Kaltenbach, Partner at Roland Berger. "Besides the immediate challenges, the sector also has structural issues to tackle such as digitalization, billing models based on medical benefit, and the shift towards personalized medicine. If MedTechs want their currently robust business models to serve them well going forward, they will need to address these areas without delay."

Regional differences: North American companies report strongest revenues and profit margins

The analysis revealed regional differences: North American companies recorded the strongest revenue gains in the analyzed period, at 21.5%. They are followed by European firms (8.6%) and organizations from the Asia-Pacific region (0.1%), which suffered the most from the impact of the pandemic and Covid-19 measures. With regards to profitability, Europe ranks third behind the other two regions. "Profits of European MedTechs have fallen below the long-term average in the past three years. This is mainly driven by the regulatory costs companies have incurred. Many are also finding their R&D budgets squeezed as a result," says Kaltenbach.

Companies specializing in lab work and diagnostics are most successful

Variances in economic performance are apparent not only across regions but across different products and services, too. Companies specializing in lab work and diagnostics were by far the most successful in 2021, reporting margins of 31.4%. These firms also saw the strongest revenue growth from 2019 to 2021 on average (23.4%). "Covid-19 significantly impacted demand in this segment. However, the momentum will be sustained even as the pandemic subsides," says Kaltenbach. Companies with diversified portfolios are also delivering very strong numbers compared to other players and are on a par with specialized providers. The weakest performers are companies that sell disposables and supplies.

Addressing the structural challenges

The study outlines six key transformation processes that the industry must face:

- The transition from traditional, paper-based systems to connected, digital processes

- The move to personalized treatment and success-based billing to replace today's service-based approach

- An increased focus on prevention and outpatient care

- The growing importance of added value in MedTech solutions

- Omnichannel sales and increasing consolidation into hospital networks that pool procurement activity

- A focus in research and development on step-change innovation for new technologies, rather than incremental advances that marginally improve the existing portfolio

"Given the volatile times we are living through, it is more important than ever to take the right strategic actions," says Marco Bühren, Principal at Roland Berger. "Especially those companies that have invested heavily in innovation over the past few decades, are demonstrating the best business performance today. So, even faced with an economic downturn, companies should weigh up very carefully whether they really want to cut back here. Now more than ever, R&D budgets must be spent on real innovation."

Topics

Categories

Roland Berger is the only strategy consultancy of European origin with a strong international presence. As an independent firm owned exclusively by our partners, we have 51 offices with a presence in all major markets. Our 2,700 employees are characterized by a unique combination of analytical thinking and an empathetic mindset. Driven by our values of entrepreneurial spirit, excellence, and empathy, we are convinced that business and society need a new, sustainable paradigm that focuses on the whole value-creation cycle. By working in interdisciplinary teams across all relevant sectors and business functions, Roland Berger offers the best expertise worldwide for successfully overcoming the profound challenges of our age now and in the future.