Press release -

Roland Berger presents "Global Carbon Restructuring Plan" for how to decarbonize the 1,000 most CO2-intensive assets

- Decarbonization of the world's 1,000 biggest CO2 emitters would achieve around a third of the emissions reduction required to reach the 1.5°C target

- The cost of this would be between USD 7.5 trillion and USD 10.5 trillion, spread over 26 years

- New study shows how a trend reversal in global CO2 emissions can be achieved

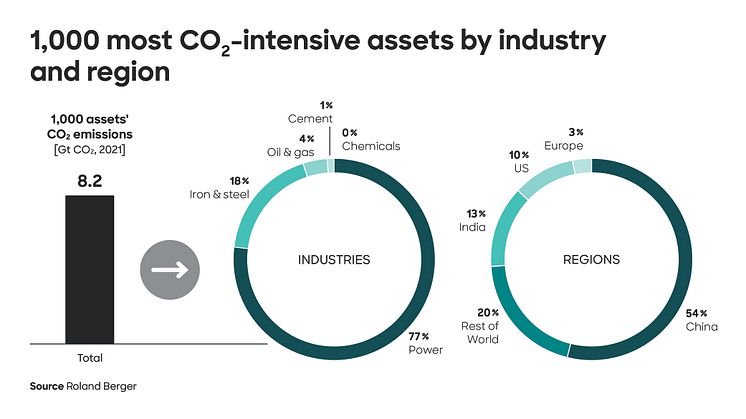

Munich, January 2024: The 1,000 most CO2-intensive industrial assets in the world are owned by 406 companies and together emit around 8 gigatons of carbon dioxide (Gt CO2) annually. If these assets were fully decarbonized, this would achieve around a third of the emissions reduction required by 2030 to reach the Paris Agreement's goal of limiting global warming to 1.5°C. Depending on the technology adopted, the cost of doing this would total between USD 7.5 trillion and USD 10.5 trillion. These are the findings of the "Global Carbon Restructuring Plan" study for which Roland Berger experts analyzed the world's 1,000 most CO2-intensive assets and identified options for decarbonizing them along with the costs involved.

To achieve the 1.5°C target, the world must reduce its annual CO2 emissions by 24 Gt by 2030, according to the Emissions Gap Report 2023. "The 1,000 industrial assets with the highest emissions emit a combined total of 8 gigatons a year – a third of the emissions reduction needed," says Martin Hoyer, Partner at Roland Berger. "Just 40 companies own the assets that produce more than half of this total, and 160 companies are responsible for 80% of it. This demonstrates the huge climate protection potential of a concerted action to decarbonize these major emitters. Our aim with this study was to identify the biggest levers to generate maximum momentum for global decarbonization efforts – across national borders and from the perspective of asset owners."

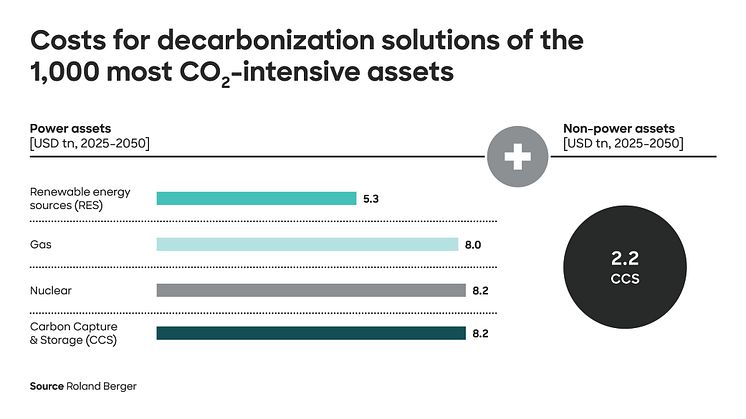

Various technology solutions can be used to decarbonize the assets, as the analysis shows. These range from switching to renewable energy, nuclear power or natural gas to adopting carbon capture and storage (CCS). The costs of complete decarbonization vary, depending on the decarbonization solution selected. Nuclear and CCS are the most expensive options at around USD 10.5 trillion each over the period from 2025 until 2050. These are followed by gas at USD 10.3 trillion. Renewables are the cheapest solution at USD 7.5 trillion. Spread over the course of 26 years, the annual costs would amount to USD 0.3 - 0.4 trillion. In comparison, this would equate to less than 20% of the world's total research and development (R&D) spending (USD 2.3 trillion) in 2021.

The vast majority of industrial assets included in the study are in the power sector

The Roland Berger experts' analysis indicates that over three quarters (77%) of the emissions from the top 1,000 assets are produced by the power sector, 18% by the iron and steel industry and 3.5% by the oil and gas sector. From a regional perspective, most of the 1,000 assets are located in China (54%) and India (13%), followed by the United States (10%) and Europe (3%). This uneven distribution across regions means that the costs of decarbonization affect countries very differently: China and India, for example, would have to spend between 18% and over 30% of their gross domestic product (GDP), while the US and Europe would only have to spend between 2% and 5% of their respective GDPs.

"The 406 owners of the 1,000 assets we examined have to analyze what their options are in their individual context and against the backdrop of the specific markets they operate in," says Hoyer. "They all face the same questions: Which technology is best? How can we ensure security of energy supply? Where will the financial resources come from? Collaborations between governments and businesses on technology and R&D could significantly increase the potential and the pace of decarbonization efforts."

The power sector lags behind on decarbonization

Commitment to switching to green production varies by sector and by region. Just 11% of the power assets identified in the study are already covered by decarbonization plans. Europe shows the most progress here, with half of its analyzed power assets having plans in place. This is the case for just under a third (29%) of the assets in the United States. Among non-power assets, the most active are oil and gas companies as well as iron and steel companies.

Topics

Categories

Roland Berger is the only management consultancy of European heritage with a strong international footprint. As an independent firm, solely owned by our Partners, we operate 51 offices in all major markets. Our 3000 employees offer a unique combination of an analytical approach and an empathic attitude. Driven by our values of entrepreneurship, excellence and empathy, we at Roland Berger are convinced that the world needs a new sustainable paradigm that takes the entire value cycle into account. Working in cross-competence teams across all relevant industries and business functions, we provide the best expertise to meet the profound challenges of today and tomorrow.