Press release -

Robust organizations: technological change forces suppliers in the automotive industry into a radical realignment

- Trend toward e-mobility increases pressure on suppliers of traditional drive technology

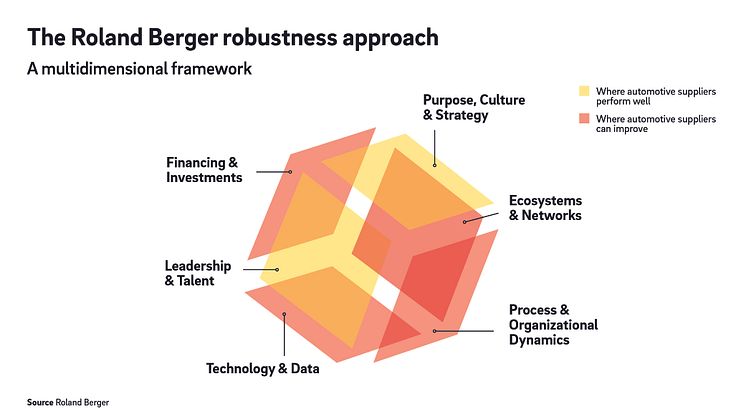

- Automotive suppliers perform well in the dimensions of Purpose, Strategy and Culture, as well as Leadership and Talent

- The biggest challenges are liquidity management, modernization of IT systems and processes, and knowledge exchange

Munich, July 2022: The automotive industry is undergoing the biggest upheaval in its history. E-mobility, autonomous driving and the increasing digitalization of vehicles are forcing OEMs and suppliers to adapt their business models to radically changed conditions. In their study, “Automotive suppliers: Achieving resilience and getting ahead in a challenging world”, Roland Berger has analyzed the situation of 35 organizations in the automotive industry based on the Roland Berger concept for robust organizations.

“Robustness means the ability of organizations to adapt and evolve, to overcome uncertainties and to preserve their ability to function, their competitiveness, and their long-term growth,” says Ina Wietheger, Partner at Roland Berger. “In other words, this means that companies have to be in a position to persist even when the foundation of their operating model changes.”

Traditional automotive suppliers face numerous challenges

The conditions in which the automotive industry operates are fundamentally changing. The study’s authors identify six drivers of this transformation. First, the trend towards e-mobility is continuing to gain momentum, not least because of more stringent international emissions guidelines. Furthermore, the industry is also being affected by the increasing digitalization of vehicles. Software is becoming more important than hardware, and this is compelling companies to rethink their own role in the value chain and requiring a significantly greater dynamic in development. What is more, the question of the technology that is used is becoming increasingly significant for investors, too. Capital flows are moving to different places as lenders are steering clear of old technologies. Furthermore, the preferences of OEMs are evolving in the sense that they are now subjecting their make-or-buy decisions to greater scrutiny. This is forcing suppliers to expand their own product offering. The fifth factor that is placing companies under pressure is the sharp rise in the cost of raw materials and resources. Lastly, the situation is being exacerbated by the demand for transparency in the supply chain and by higher sustainability requirements.

“Ultimately, the consequence of these factors is that almost all suppliers – but especially those of traditional powertrain components – are having to rework their operating models. All the departments in a company have to understand the scale and the direction of the transformation – and adapt accordingly. Revenue sources, cost structures and investments will change and will have to be rethought,” says Felix Mogge, Partner at Roland Berger.

Six dimensions of robust organizations and the performance of automotive suppliers

Roland Berger’s concept for robustness entails six dimensions along which the situation of the 35 automotive-industry organizations was analyzed. The companies performed well in two dimensions. They came out as well-positioned in Purpose, Culture and Strategy. A common objective and good corporate culture are important in times of change, especially for automotive suppliers. The Leadership and Talent section also revealed a further strength of suppliers as they often already make concerted efforts to support and develop their employees.

However, action is required in the following four dimensions of a robust organization. The far-reaching transformations in the fields of electrification and software are leading to significant CAPEX and R&D expenditures. Therefore, further improvements are necessary in the Financing and Investments dimension, especially in liquidity management. In the Process and Organizational Dynamics dimension, automotive suppliers are not yet fully exploiting their potential in knowledge exchange across departmental and function-based boundaries. Furthermore, the establishment of ecosystems and networks within the industry is not yet at reference level, although first partnerships and industry networks are becoming visible. With regard to the Technology and Data dimension, the IT infrastructure is one key component that in many cases is not in line with the technological standards of the industry. However, many companies have identified this weakness and have already started work on rectifying it.

Topics

Roland Berger is the only strategy consultancy of European origin with a strong international presence. As an independent firm owned exclusively by our partners, we have 51 offices with a presence in all major markets. Our 2,700 employees are characterized by a unique combination of analytical thinking and an empathetic mindset. Driven by our values of entrepreneurial spirit, excellence, and empathy, we are convinced that business and society need a new, sustainable paradigm that focuses on the whole value-creation cycle. By working in interdisciplinary teams across all relevant sectors and business functions, Roland Berger offers the best expertise worldwide for successfully overcoming the profound challenges of our age now and in the future.