Press release -

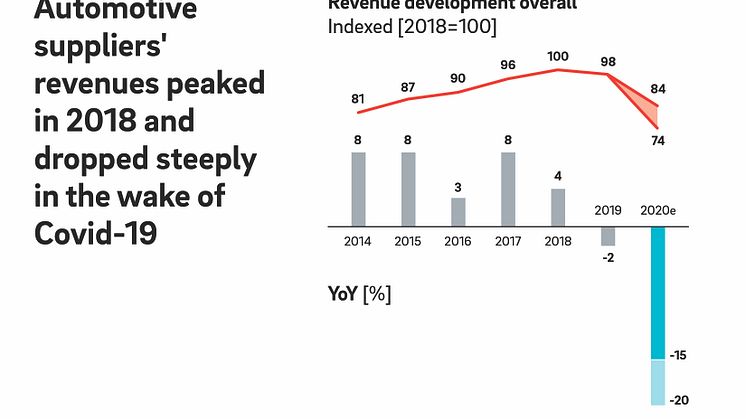

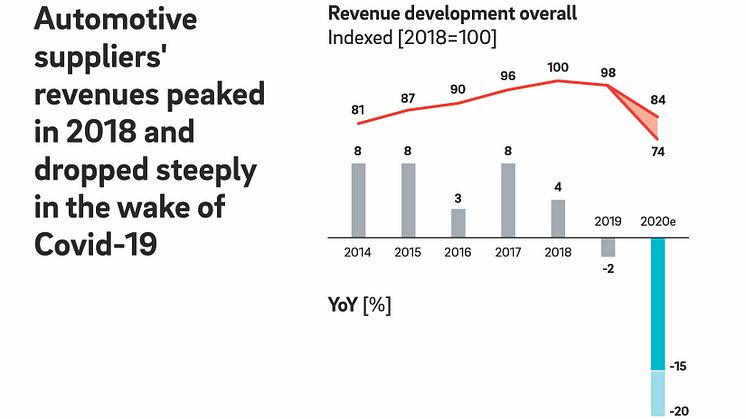

Pandemic intensifies margin pressure on automotive suppliers – sales expected to decline globally by 15 to 20 percent in 2020

- EBIT margins fell to a historic low of 1.7 percent in the first half of 2020

- Car sales in North America and Europe expected to reach pre-crisis levels only after 2026

- Suppliers must balance restructuring and strategic realignment

Munich/Frankfurt, November 2020: Electromobility, autonomous driving and digital transformation of cars: Technological change continues to put pressure on margins of automotive suppliers. The Covid-19 pandemic has further intensified this trend. As a result, this year's global sales are expected to slump by an average of 15 to 20 percent compared to 2019. Suppliers’ average EBIT margin fell to 1.7 percent in the first half of 2020. The pandemic’s effect on automotive suppliers is revealed in the "Global Automotive Supplier Study 2020" from Roland Berger and Lazard. The study analyzes performance indicators of approximately 600 suppliers around the globeto assess the current state of the industry, as well as trends and challenges.

"Despite difficult underlying data, a brighter year-end is emerging. Automotive suppliers are able to stabilize financially, mainly thanks to the rapid recovery process in China," says Felix Mogge, Partner at Roland Berger. "However, many suppliers lack the capital for the necessary technological transformation following the slump.”

Poor key figures affect creditworthiness

Overall, the coronavirus shock will affect the automotive industry for a long time to come. The peak volume of global vehicle sales that was reached in 2017 (94.3 million) is not expected to be met again until 2026. In Europe and North America, it will take even longer while China and South America will recover more quickly, according to the report.

Together with poor key financial indicators, these forecasts may have a negative impact on the creditworthiness of automotive suppliers. "In 2019 we already observed banks becoming more restrictive in their credit financing," says Christof Söndermann, Managing Director at Lazard. "In recent months, many suppliers were confronted with rating downgrades. This increased financial pressure further."

Lessons from the post financial crisis era 2008/09

The current situation can be compared to the global financial crisis in 2008 and 2009. In the period that followed, some automotive suppliers benefited more than the average. "We identified four general characteristics that were crucial to success after the financial crisis," says Felix Mogge. "Suppliers can use these to orient themselves and gain a better position in the market based on clear strategic guidelines."

One characteristic that will distinguish the winners from the losers of the coronavirus crisis in coming years is consistent market and technology leadership in every business area. Another is strategic coherence, which includes having a coherent product portfolio that allows for the realization of synergies. The third characteristic is the achievement of a critical company size to ensure sufficient access to the capital markets. Finally, winners will demonstrate consistent implementation of their strategic decisions and a performance-driven corporate culture.

Balancing act between restructuring and strategic realignment

Technological change and the effects of the Covid-19 pandemic will continue to impact the margin performance of automotive suppliers for the foreseeable future. "The challenges of the coming years will structurally overwhelm many suppliers," predicts Felix Mogge. "As a consequence, we will see greater consolidation in the industry." In order to be among the winners in this environment, automotive suppliers must strategically develop their business and at the same time significantly reduce costs.

"An automotive supplier’s CEO and management team have to walk a fine line: On the one hand, they have to consistently restructure or exit their commodity activities, while on the other hand, they must take risks with intelligent capital spending to develop new areas for future profitable growth," says Christof Söndermann. "We therefore expect to increasingly see strategic cooperations in order to achieve relevant scale or to get access to new technology more quickly."

Roland Berger

Roland Berger, founded in 1967, is the only leading global consultancy of German heritage and European origin. With 2,400 employees working from 35 countries, we have successful operations in all major international markets. Our 52 offices are located in the key global business hubs. The consultancy is an independent partnership owned exclusively by 250 Partners.

Lazard

Lazard, one of the world's preeminent financial advisory and asset management firms, operates from more than 40 cities across 25 countries in North America, Europe, Asia, Australia, Central and South America. With origins dating to 1848, the firm provides advice on mergers and acquisitions, strategic matters, restructuring and capital structure, capital raising and corporate finance, as well as asset management services to corporations, partnerships, institutions, governments and individuals. For more information on Lazard, please visit www.lazard.com. Follow Lazard at @Lazard.

Topics

Roland Berger is the only management consultancy of European heritage with a strong international footprint. As an independent firm, solely owned by our Partners, we operate 51 offices in all major markets. Our 3000 employees offer a unique combination of an analytical approach and an empathic attitude. Driven by our values of entrepreneurship, excellence and empathy, we at Roland Berger are convinced that the world needs a new sustainable paradigm that takes the entire value cycle into account. Working in cross-competence teams across all relevant industries and business functions, we provide the best expertise to meet the profound challenges of today and tomorrow.