Press release -

MedTech industry: Falling margins worldwide hit German companies hard

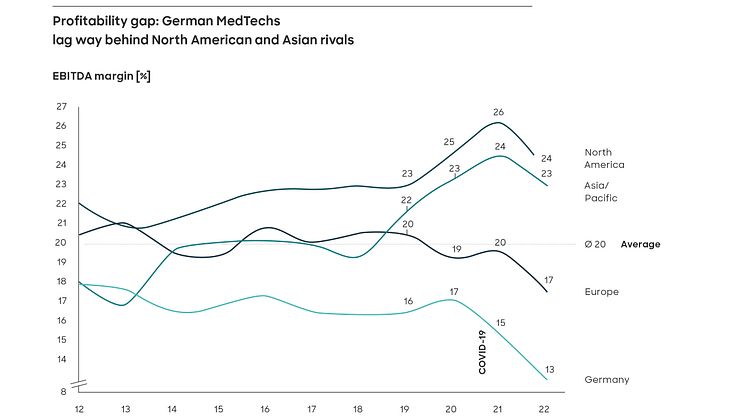

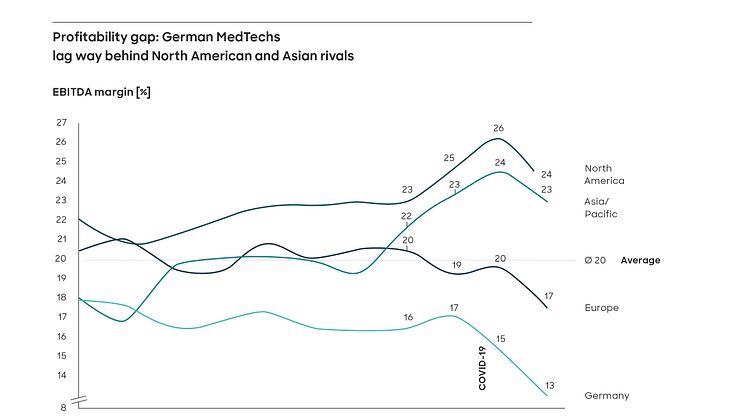

- Average profit margins of German MedTech companies fall from 17% in the first half of 2022 to 14% in the first half of 2023

- North American MedTechs maintain their profitability lead

- The most profitable segments are lab and diagnostics solutions (26%) and surgical instruments (22%)

Munich, November 2023: The MedTech industry saw profitability slide in 2022 and 2023 as energy, raw-material and wage costs rose and global supply chains faced disruption. Companies headquartered in Germany were under the most pressure, with their average EBITDA dropping to just 14% of revenues in the first half of 2023, three percentage points down on the previous year and eight percentage points behind their North American peers. Yet there were stark differences within the industry: The worst performers were disposables and supplies manufacturers (12%), whereas companies offering lab and diagnostics solutions (26%), surgical instruments (22%) and medical aids and devices (18%) performed relatively well. These are among the findings of the Global MedTech Study 2023, for which Roland Berger experts analyzed more than 100 of the world's leading stock-listed companies in the industry.

"Revenues in the global MedTech industry are still growing by about 8% on average per year, but recently costs have been rising disproportionately, mainly as a result of geopolitically induced energy and raw-material price increases and inflation-driven salary rises," says Thilo Kaltenbach, Partner at Roland Berger. "Companies have tried to pass on their higher production costs to customers, but most have not been able to do so fully. That is why profit margins have been falling worldwide."

The analysis reveals dramatic differences, both between regions and between segments of the industry: Germany had a higher share of underperforming companies than the rest of Europe, North America or Asia/Pacific. Whereas average margins in the US and Canada declined from 25% to 22% between mid-2022 and mid-2023, and European MedTech companies' EBITDA fell from 20% to just 17% of revenues, profitability in Germany shrank from 17% to 14%.

In terms of segments, lab and diagnostics equipment remained the most profitable part of the industry, enjoying average margins of 26% in the first half of 2023; profits here were one percentage point below the second half of 2022 and five points off the pandemic-induced all-time highs seen in 2021. The situation was similar in surgical instruments and medical aids and devices, where EBITDA of 22% and 18%, respectively, saw them back at pre-pandemic levels.

Optimization programs are having an impact

Margins in the dental segment fell one percentage point to 14%. Here, innovation and digitalization have seen significant improvements in companies' service portfolios. Resulting strong revenue growth has in part countered the effects of fierce competition and significant bargaining power on the customer side. The segments with the lowest margins, at 12%, remain services and disposables and supplies, which have respectively been suffering under recent inflation-induced salary increases and limited product differentiation. But both segments were the only ones able to stabilize – and even slightly improve – margins in the first half of 2023. "Companies in these fields appear to be profiting from performance-improvement programs that have led to more automation and headcount reductions," says Marco Bühren, Principal at Roland Berger.

The Roland Berger experts consider the shrinking profit margins to be a sign of the pressure the MedTech industry is under right now. But the study also shows that not all companies are affected in the same way, with some less hard hit than others. "To thrive in this difficult competitive situation, companies need to be asking what it is that the more successful businesses are doing better than the underperformers," says Kaltenbach. "There is no single recipe for success, but our analysis shows that the strongest companies share four crucial characteristics. These are excellence in business leadership, strategic coherence, a proven ability to execute and an appropriate size and financial position. Moreover, businesses should by now be translating their investments in robotics and digitalization into profitable business models. Long term, they also need a 'license to operate' based on good environmental, social and governance (ESG) performance. Companies that apply these levers have every chance of safeguarding their profitability and their business success going forward."

Topics

Categories

Roland Berger is the only management consultancy of European heritage with a strong international footprint. As an independent firm, solely owned by our Partners, we operate 51 offices in all major markets. Our 3000 employees offer a unique combination of an analytical approach and an empathic attitude. Driven by our values of entrepreneurship, excellence and empathy, we at Roland Berger are convinced that the world needs a new sustainable paradigm that takes the entire value cycle into account. Working in cross-competence teams across all relevant industries and business functions, we provide the best expertise to meet the profound challenges of today and tomorrow.