Press release -

Market for digital healthcare set to grow to EUR 232 billion by 2025

- Digital healthcare to see almost 50 percent growth in the wake of the Covid-19 pandemic

- Patients with preexisting conditions trust small-to-medium-sized platform providers the most

- Partnerships of specialized platforms offer promising opportunities for all market participants

Munich, October 2020: Before the Covid-19 pandemic hit, many patients were very skeptical about seeing their doctor via video consultation or sending data to healthcare providers electronically. This attitude is changing as people grow accustomed to using digital products and services. And that is creating growth in the digital healthcare market. These are among the findings of the latest Roland Berger study, "Future of Health 2 – The rise of healthcare platforms", which canvassed the opinions of some 500 experts worldwide.

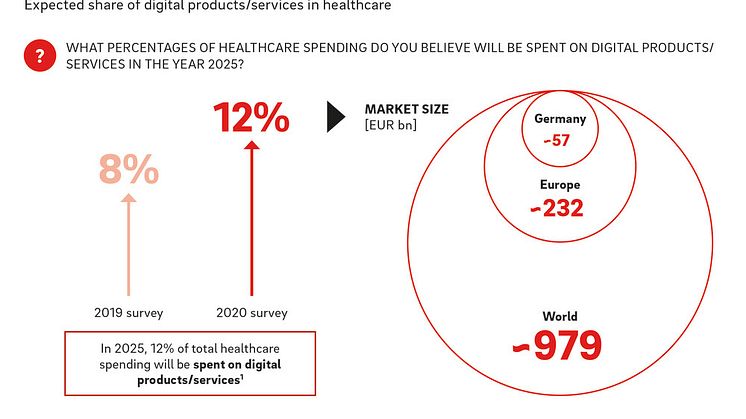

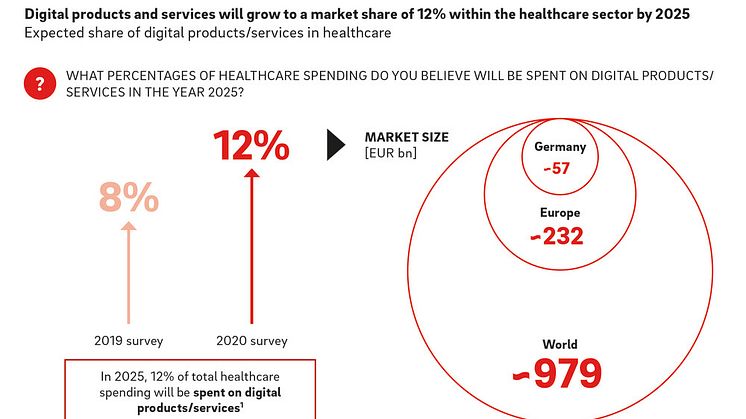

Anticipated market growth is almost 50 percent higher than the expectations expressed in the previous year's study, with Europe's digital healthcare market now forecast to grow to EUR 232 billion by 2025. The German market is predicted to be worth EUR 57 billion. Experts believe the pandemic will accelerate the process of digitalization in the industry by about two years. "This year's study findings are significantly more optimistic than last year's," notes Karsten Neumann, Partner at Roland Berger and one of the study authors. "We therefore expect this market to be very dynamic, with merger and acquisition activity predicted in the coming years as a result."

Good opportunities for specialized platform operators

The faster pace of growth brought by the pandemic is acting on a market that is highly fragmented. On the one hand you have big tech – companies with vast quantities of data at their disposal – jostling for position. And then there are also many smaller providers bringing to market apps and specialized solutions for certain indications, like diabetes. In 2019, 61 percent of experts were of the opinion that tech companies would definitely be an integral part of the healthcare system in the period through 2025. The latest survey results, however, reveal that only ten percent of patients with preexisting conditions would entrust these companies with their data. "We can therefore see greater opportunities for companies and platform providers from within the healthcare system, who would be acting as interfaces, combining virtual and physical services alike," says Neumann.

Providers of outpatient services will also need to adapt to the new platform models. If they do not, they run the risk of being marginalized or even forced out of the market in the medium term. Some 64 percent of survey respondents foresee a change in the business models for outpatient services. "It's important for providers to set themselves up now for what's to come," advises Karsten Neumann. "They need to consider which platforms could be a threat to them, or where and what network they should expand their own business model into."

Platforms already successful internationally

New players are also entering the market with adapted business models. Startups are intensifying competition in all of the associated industries – from big pharma to insurance companies and from service providers to other startups and tech firms. "More and more companies are specializing. That means, by definition, that they need to be interconnected, if only to be able to offer an end-to-end user journey," explains Neumann. "Relevant partnerships that benefit all involved parties will be a key success factor going forward."

This trend is underlined by a range of practical examples. There's an insurance company in Mexico that's already bringing 22,000 providers together with more than 250,000 patients on a single platform. A Chinese company offers another platform that consolidates large datasets, online appointments and various different health programs. And in Saudi Arabia, platform integration is already part of the overall healthcare system. If European companies want to keep up with these frontrunners, they'll need to redefine their strategies. "A platform strategy offers every opportunity for market players of all kinds. This will not be a 'winner takes all' scenario," says Neumann.

Topics

Categories

Roland Berger, founded in 1967, is the only leading global consultancy of German heritage and European origin. With 2,400 employees working from 35 countries, we have successful operations in all major international markets. Our 52 offices are located in the key global business hubs. The consultancy is an independent partnership owned exclusively by 250 Partners.