Press release -

Global consumer behavior 2025: Greater optimism leads to higher spending and continued growth for online and new platforms

- Major regional differences: 85% of consumers in China are optimistic, while 52% in Germany feel pessimistic

- Customers value online channels for their price, convenience and product variety, while offline channels are better for advice and shopping experience

- Retailers and brands must optimize their online and offline offerings to stay competitive

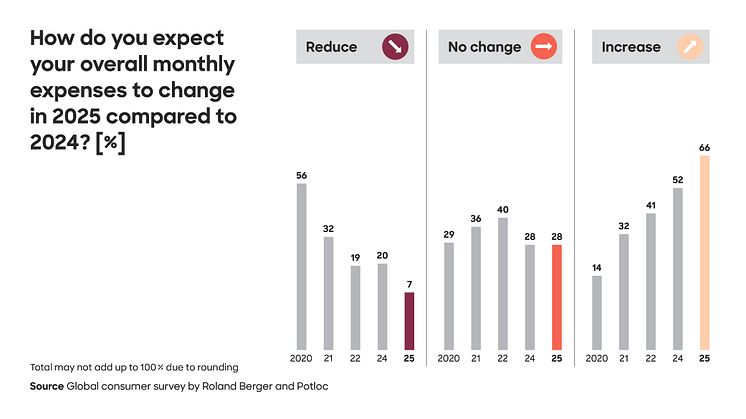

Munich, April 2025: Consumer sentiment remains optimistic overall, in spite of global uncertainties. However, stark differences in mood exist between regions, with consumers feeling more confident in emerging economies and more cautious in developed markets. These are among the findings of the fourth in the series of "Decoding consumer behavior" studies in which Roland Berger and Potloc analyze consumer behavior worldwide. The share of survey participants with a positive outlook is highest in China at 85%, followed by the United Arab Emirates at 79%, whereas the share of respondents who say they feel pessimistic is 52% in Germany and 42% in the United Kingdom. These findings reflect the distinct economic, social and political challenges faced by different regions. A combination of regional optimism, rising costs and inflationary pressure means that 66% of survey respondents expect to increase their monthly spending in 2025 – up 14 percentage points on 2024. Partly in response to this, 38% plan to do more of their shopping online, both on established retailers' online websites and on new social commerce platforms. This presents a challenge that retailers can address with a dual-channel strategy to fulfill customers' needs for convenience, efficiency and product discovery on the one hand, and for advice and the shopping experience on the other.

Roland Berger and the market research platform Potloc surveyed a total of 3,000 consumers from the United States, China, Brazil, Germany, the United Arab Emirates and the United Kingdom for the study (500 participants from each country). “Besides an overall increase in optimism, our analysis reveals a certain consistency in consumer behavior," says Thorsten de Boer, Partner at Roland Berger. "Many survey respondents plan to keep their consumption constant in 2025 and anticipate only a slight increase in spending. They therefore remain price-conscious and continue to seek bargains. This is leading to an increase in online shopping, particularly in China. On average globally, there are no major changes in consumers' shopping and consumption behavior – but regional differences exist."

The study authors attribute the significant variation in consumer sentiment between the analyzed countries to regional specifics. In China, for example, strong domestic demand and government support initiatives are driving the strong positive outlook (85%). By contrast, the pessimistic mood in the United Kingdom (42% negative outlook) and Germany (52%) is based on factors such as the proximity to Russia's war in Ukraine, political change in the United States and the sustained domestic economic slowdown. Indeed, Germany was hit harder by inflationary pressures in late 2024 than other Eurozone countries. Added to that, ongoing economic stagnation, coupled with the job cuts announced by major German companies, has further weakened consumer confidence and spending power. As a result, respondents in Germany report the lowest willingness to spend more in 2025.

Key purchase criteria are price, quality and brand reputation

In addition to finding that online channels are continuing to grow in importance overall, the survey provides further key insights for retailers and brands. For example, respondents primarily cite convenience and easy access to a wide range of products as reasons for using online marketplaces, but they prefer offline channels, especially those of large retail chains, for their customer support and shopping experience. When it comes to the final purchase decision, consumers say that price, quality and brand reputation are the most important criteria.

In addition, many consumers, especially in China, are open to using new channels: 48% of respondents find the recent phenomenon of social commerce platforms attractive because it is easier to discover new products there. Although around a quarter of consumers report bad experiences, such as with customer support, these platforms are well positioned to fulfill consumers' desire for value for money and shopping experience and thus to capture a growing share of the online market.

Based on these and other findings of the study, Roland Berger's retail experts developed a series of recommendations for market participants. "To retain customers, retailers and brands must meet consumers' needs as fully as possible," says Richard Federowski, Partner at Roland Berger. "Key to this is, among other things, having an optimized dual-channel strategy offering convenient access to a wide range of products and a high level of efficiency in the online channel, alongside an offline channel ensuring experiential shopping with advice and excellent customer support. We also recommend adapting the retail offering to changing consumer needs and market dynamics – and not just on a one-time basis but continuously."

Topics

Categories

Roland Berger is one of the world's leading strategy consultancies with a wide-ranging service portfolio for all relevant industries and business functions. Founded in 1967, Roland Berger is headquartered in Munich. Renowned for its expertise in transformation, innovation across all industries and performance improvement, the consultancy has set itself the goal of embedding sustainability in all its projects. Roland Berger revenues stood at more than 1 billion euros in 2023.