Press release -

European aerospace industry: Full order books, but high hurdles in increasing production

- Roland Berger survey of around 150 companies from Germany, France, and the UK on resilience and structure of supply chains

- Two-thirds report production disruptions due to supply chain problems; situation worsened compared to 2023

- Just under half of the companies are actively working on repositioning or optimizing their supply chain structures; more European and international cooperation needed

Munich, June 2024: One-third of Europe's aerospace companies currently do not consider themselves well positioned to implement the upcoming production increases. The situation is particularly difficult for small and medium-sized enterprises, which lack capital for investments among other issues, coupled with a shortage of skilled workers and other resources, such as raw materials or intermediate products. Especially supply chain issues remain problematic: 66 percent of companies report production disruptions due to supply interruptions, and they assess the consequences to be even more severe than in 2023. Yet, just under half are working on a conversion or optimization of their supply chain structure to make it more resilient to disruptions. This is shown in a study by Roland Berger in cooperation with the Federal Association of the German Aerospace Industry (BDLI), as well as the aerospace associations from Great Britain, ADS, and France, GIFAS. Under the title "Study on the Resilience of the Aerospace Supply Chain in Germany, France, and the UK," with around 150 companies surveyed, the study paints a comprehensive picture of the European aerospace industry.

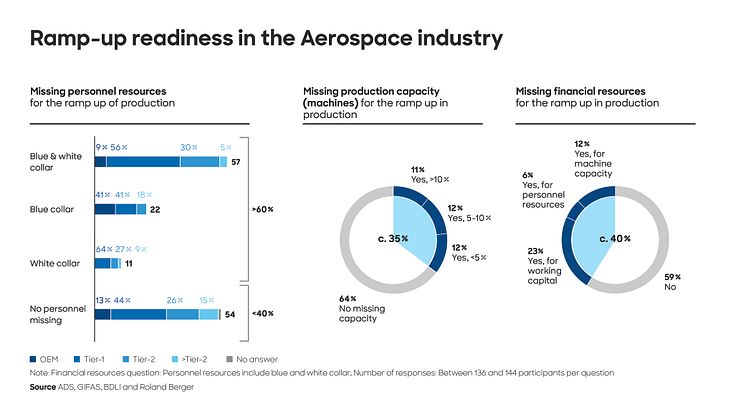

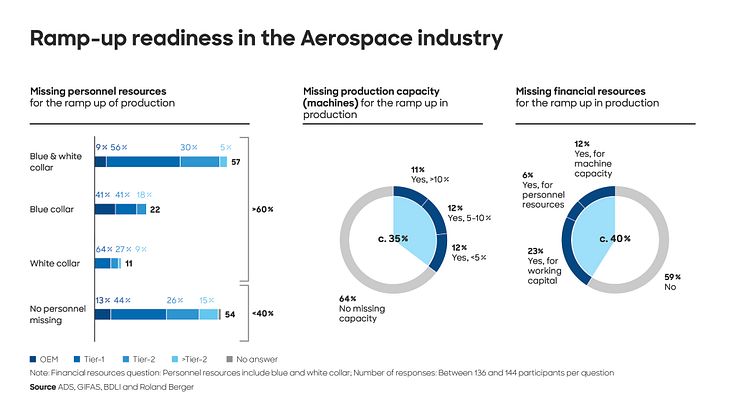

"The race to catch up after the collapse in the Corona years is in full swing, and the order books of the European aerospace industry are correspondingly full," says Stephan Baur, Partner at Roland Berger. "To process this backlog of orders, the number of civilian aircraft delivered must almost double by 2030. But many companies, especially among smaller and medium-sized suppliers, currently do not see themselves capable of ramping up their production accordingly." Over 60 percent of the surveyed companies are struggling to find the necessary skilled workers for the ramp-up, 40 percent report a lack of capital for investments. And for a good 35 percent, insufficient production capacities are a challenge.

There are also problems with supply chains: Two-thirds of respondents (66%), especially Tier 1 suppliers, report disruptions, for example, due to longer lead times or limited availability of raw materials and intermediate products. The result is unreliable deliveries and short-term bottlenecks. Price increases, fluctuating quality, inaccurate demand forecasts, and legal regulation are also on the list of difficulties. The severity of the impact has also increased: the number of companies stating they are "very much" affected by supply chain disruptions has risen from two to eleven percent compared to the previous year. Here too, Tier 1 suppliers are disproportionally represented.

Resilience of supply chains indispensable for ramp-up of production rates

"In view of the multitude of crises facing companies, it is not surprising that the number of those in firefighting mode has increased again compared to last year," says Baur. But acting reactively is not enough: "This may help to manage a disruption in the short term, but long-term stabilization requires more resilience of the supply chains – and this can only be achieved with structural adjustments." The recommendation of the Roland Berger experts is to first conduct a fundamental analysis of the supply chain. On this basis, measures can then be developed and implemented, using, among other things, best-practice examples, with which a supply chain can be built that is truly crisis-proof and also offers cost advantages.

The aerospace associations also support this. Thus, the BDLI has launched the "AeroExcellence" initiative. "With this, we want to help supplier companies to identify optimization potentials along their entire value chain," says Stefan Berndes, Head of Aviation, Equipment, and Materials at BDLI. He also points to another important issue: "Apart from measures at the individual company level, we also need more European and international cooperation in the aerospace industry to diversify supply chains and make them more resilient. We are working on this together with the other European associations, including through this joint study. It clearly shows that the industry is going through a difficult situation across Europe that needs to be resolved in order to be able to take advantage of the positive momentum from the order boom."

Categories

Roland Berger is one of the world's leading strategy consultancies with a wide-ranging service portfolio for all relevant industries and business functions. Founded in 1967, Roland Berger is headquartered in Munich. Renowned for its expertise in transformation, innovation across all industries and performance improvement, the consultancy has set itself the goal of embedding sustainability in all its projects. Roland Berger revenues stood at more than 1 billion euros in 2023.