Press release -

Energy efficiency services market to grow to EUR 50 billion in Europe by 2025

- Political climate change targets, the green energy transition and innovations drive demand for energy efficiency services

- Market growing by about 8 percent p.a. across Europe and 7 percent in Germany

- Software (+14% p.a.) and engineering (+9%) are the fastest growing subsegments of the market

Munich, February 2019: Rising energy costs and growing climate change commitments are increasing the pressure on companies to be as efficient as possible in their resource consumption. As a result, we are observing pan-European growth in the demand for energy efficiency services (EES), which help companies identify and realize their individual savings potential. In their latest study, Energy Efficiency Services in Europe, the experts from Roland Berger concluded that the volume of such services will double by 2025, producing a market worth some EUR 50 billion (Download study here)

"The market for energy efficiency services is very dynamic but it is also fragmented and not very transparent," says Ralph Büchele, Partner at Roland Berger. "As a result, EES providers have so far found it very difficult to gauge their growth potential in this environment and to see what the risks are and where investments would pay off." Through their systematic analysis, the study authors bring transparency to the market for industry incumbents and new market entrants alike.

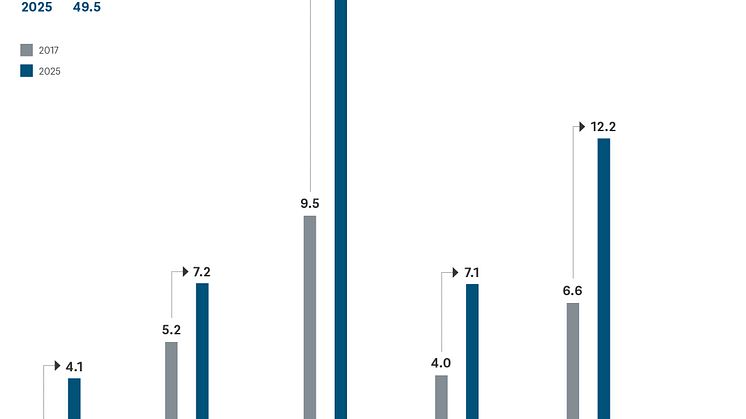

Five lead markets with differing growth potential

The Roland Berger experts define five lead markets in which EES providers operate: The smallest but fastest growing is the market for energy efficiency software (growing at +14 percent per annum). The slowest growth (+4 percent p.a.) is seen in the sector for energy efficiency audits and consulting. The biggest subsegment is the market for engineering, procurement and construction (EPC) of energy efficiency technology, which makes up about 40 percent of the total market and is growing at 9 percent p.a. The remaining two sectors, efficient operations and energy efficiency contracting, are also set to grow at a healthy rate of 8 percent per annum each.

On average, the total market for energy efficiency services in Europe is growing at around 8 percent p.a. in the period through 2025. Market development in Germany is also very positive at about 7 percent p.a. Germany accounts for almost 25 percent of the value of EES services sold in Europe, making it a lucrative market for all types of EES providers.

"There are many influences driving this positive development," explains Ralph Büchele. "Policymakers and business leaders alike are under pressure from the need to meet climate change targets, be it in terms of operating more sustainably or through continuing to push the green energy transition. Technological progress is another factor: "We expect digitalization alone to increase the size of the market for EES services by EUR 13 billion by the year 2025," forecasts Ralph Büchele.

Success strategies in a complex market

So far, the market is mainly populated by small and medium-sized players – only some of them are entirely focused on EES. Others are not, and it's this diversity that not only creates a highly fragmented and complex market but in fact increases the fragmented and complex nature of the companies themselves.

Market players need to plan their growth strategies meticulously. There are various ways to grow in this market: targeted acquisitions represent one promising option. Positive examples in the market show that a specific strategy needs to be applied to the selection and integration of any acquired businesses. Companies should also build digital tools into their portfolio. For example, the ability to efficiently handle services for customers on digital platforms can create a competitive edge. "If an EES player sees itself becoming too complex as a result of serving many different markets, they should think about moving some of the services outside the company, such as into a subsidiary," advises Ralph Büchele, adding, "Integrated business models and flexible organizational structures are a basic prerequisite for fast business growth."

Related links

Topics

Roland Berger, founded in 1967, is the only leading global consultancy of German heritage and European origin. With 2,400 employees working from 35 countries, we have successful operations in all major international markets. Our 52 offices are located in the key global business hubs. The consultancy is an independent partnership owned exclusively by 230 Partners.

For further information, please contact:

Roland Berger

Claudia Russo

Head of Marketing & Communications

Germany, Austria and Switzerland

Tel.: +49 89 9230-8190

E-mail: Claudia.Russo@rolandberger.com