Press release -

Companies recognize the strategic importance of ESG, but only one in thirteen think they are doing an excellent job on ESG compliance

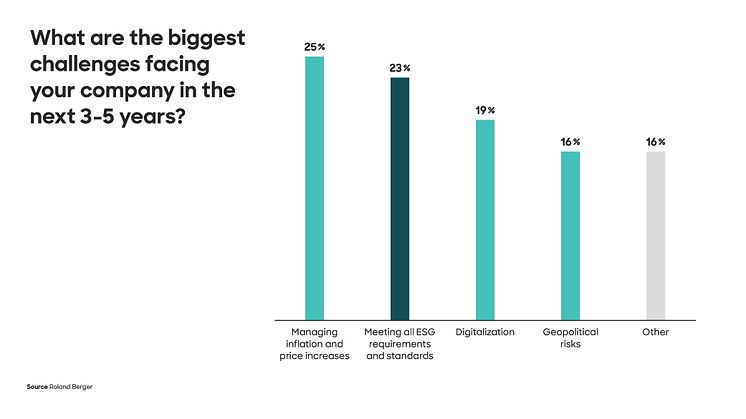

- Roland Berger study: Corporate leaders today perceive ESG as a challenge second only to the task of managing inflation and price increases

- More than 70% of companies are legally obligated to meet ESG requirements; sustainability matters offer additional potential to add value when tackled strategically

- Best-in-class ESG performers have an organizational structure and corporate culture committed to ESG, as well as proactive engagement at leadership level and advanced technology

Munich, October 2024: Meeting ESG requirements and standards is perceived as one of the most pressing challenges to corporate organizations – surpassed only by the immediate concerns of inflation and price increases. Nevertheless, more than 40% of companies feel they are not yet performing well on ESG (Environment, Social, Governance), and only one in thirteen (7.6%) think they are doing an “excellent” job. These are among the findings of a Roland Berger study for which the authors surveyed managers and employees at 158 international companies to determine how ESG requirements are being implemented. The study also highlights what distinguishes the front-runners from those lagging behind on implementation: Crucial aspects are the right structures, informed and engaged leadership, advanced technologies, and a culture in which ESG principles are acknowledged and ingrained.

"More than 70% of European companies are legally required to comply with the EU's new Corporate Sustainability Reporting Directive (CSRD)," said Andreas Stocker, Partner at Roland Berger. "And even businesses that are not obligated must engage with it – for instance because their status as suppliers makes them indirectly impacted by it. That is why it is such an important topic for corporate leaders." In total, 23% of respondents cited meeting all ESG requirements and standards as the biggest challenge facing their company in the next three to five years, only marginally surpassed by the most critical challenge currently, which is managing inflation and price increases, cited by 25%. These are followed at some distance by digitalization (19%) and geopolitical risks (16%).

Companies thus acknowledge the importance of ESG, but only 7.6% think they are doing an "excellent" job of ESG compliance, whereas more than 40% of businesses across all sectors feel their performance is "poor" or "decent" at best. "Many companies face organizational challenges that prevent them from excelling in the three ESG dimensions," said Stocker. "Often, there is an absence of clearly designated and dedicated responsibility for the topic, insufficient leadership engagement, and inadequate support from top management." The challenges are compounded when no specific budget is earmarked for ESG activities and a lack of tailored ESG training programs means that employees are not empowered with the necessary skills and knowledge to get the job done.

ESG is not just a legal requirement but a strategic advantage

Nevertheless, the Roland Berger experts found that nearly half (48%) of the organizations surveyed have ESG matters anchored at board level. In addition, ESG managers report directly to the CEO in 50% of cases, while around 15% report to CFOs or COOs. "This trend towards ESG management being centralized and embedded right at the top of the decision-making hierarchy demonstrates that companies attach high strategic priority to their sustainability goals," said Stocker. "And this suggests that companies prioritize ESG not just out of legal obligation but because they see tangible benefits for their customer relationships and market positioning."

So, for the 7.6% of surveyed companies who, by their own judgment, are outperforming their peers, what sets these "ESG leaders" apart? For one thing, many more of them (89% compared to 76% of those "lagging behind") have a dedicated ESG organizational structure. This approach points to a proactive policy of embedding ESG in the organization's DNA. They are also more likely (59% vs. 38%) to assign ESG responsibilities at board level, and in more cases (54% vs. 45%) ESG managers report directly to the CEO – both evidence of the high strategic priority these companies give to ESG issues. The same goes for allocating a dedicated budget to ESG activities, which 84% of ESG leaders do, compared to 61% of other companies. And finally, most ESG leaders (87%) train their staff on ESG-related issues and thus raise awareness and understanding of ESG issues across the organization – a commitment that drops to just 56% among the rest.

"Looking at the best-in-class companies, it is very evident that they have taken the leap from reactive compliance to the proactive valorization of sustainability," said Stocker. "They have made ESG a cornerstone of their corporate identity and a crucial ingredient in their operational excellence." Adopting this systematic and proactive approach is what the Roland Berger experts would recommend to all companies that think they are not yet properly positioned on ESG. "Delaying ESG initiatives is not an option," said Stocker. "ESG is here to stay. It is an opportunity to optimize your business and future-proof your organization, while also doing something for the future of our planet."

Topics

Categories

Roland Berger is one of the world's leading strategy consultancies with a wide-ranging service portfolio for all relevant industries and business functions. Founded in 1967, Roland Berger is headquartered in Munich. Renowned for its expertise in transformation, innovation across all industries and performance improvement, the consultancy has set itself the goal of embedding sustainability in all its projects. Roland Berger revenues stood at more than 1 billion euros in 2023.