Press release -

Automotive Disruption Radar: Traditional OEMs drive the transformation

- Share of electric cars in global vehicle sales rises to nearly 7%

- China's electric vehicle market dominated by homegrown carmakers

- First fully autonomous vehicle services expected to start appearing from 2030

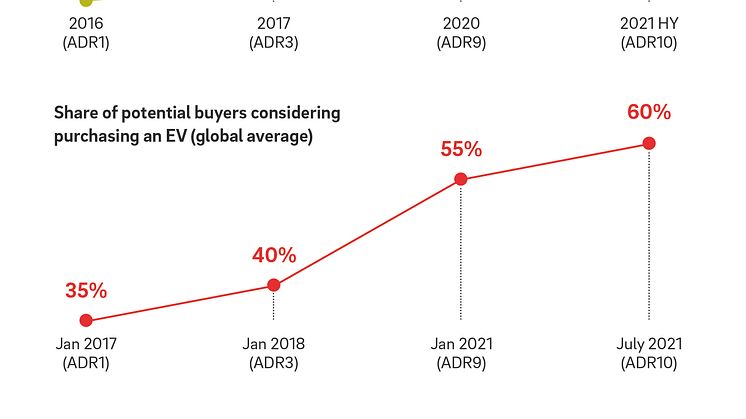

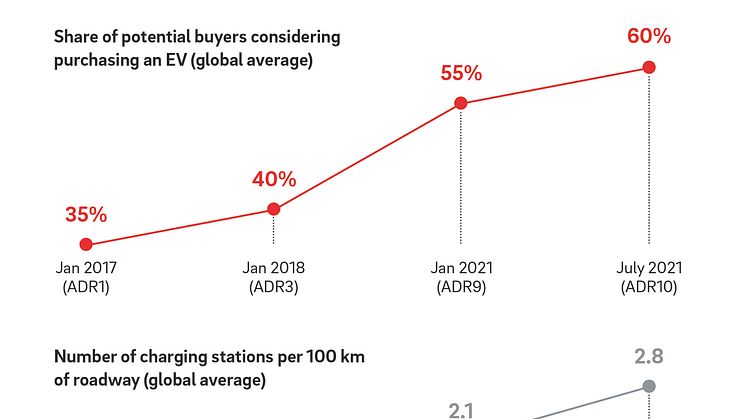

Munich, October 2021: Even though the automotive industry is still battling the effects of the Covid-19 pandemic, there is no stopping the new technology revolution. This is one of the findings of the latest Automotive Disruption Radar (ADR) study by Roland Berger. The twice-yearly report tracks 26 indicators of automotive disruption across 23 nations. The tenth edition of the study highlights how much progress the industry has made since the first analysis was published in early 2017. The share of electric and plug-in hybrid vehicles sold as a percentage of total global vehicle sales has jumped from 1.5% in 2017 to 6.9% this year. The number of charging stations per 100 km has more than quintupled. And while many of the big OEMs want 50% of their new cars to be battery electric by 2030, four in ten survey respondents want to see an end to all sales of internal combustion engine vehicles by that date.

"Electric vehicles made their breakthrough last year, and the latest results have now shown a significant jump in progress on all electrification indicators," says Wolfgang Bernhart, Partner at Roland Berger. "Despite the Covid-19 pandemic, developments around disruptive mobile technologies powering the electric revolution and autonomous driving are picking up pace."

The transition from internal combustion engine (ICE) vehicles to fully electric vehicles (EVs) is being driven by more than the emergence of all-electric market newcomers and pressure to reduce fleet emissions. Many traditional OEMs have now placed themselves in the vanguard of the electric revolution, with some planning to achieve carbon neutrality by 2050. The moves by the big OEMs are in line with what customers want: 60% of potential buyers are considering purchasing an electric vehicle and 40% of our respondents would like to see sales of ICE vehicles stopped by 2030.

Electric cars see the strongest market penetration in Scandinavia

The Netherlands again tops the Automotive Disruption Radar ranking, as it has many times in the past years, followed by China, Sweden and Singapore. Among this year's five new additions (Norway, Israel, Brazil, Thailand and Indonesia), Norway leads the way, going straight into fifth position behind Singapore. The Nordic nation has with 79% a great share of EV and plug-in hybrid vehicle (PHEV) sales as a percentage of total vehicle sales. By way of comparison, second-placed Sweden achieves 39% and third-placed Germany only 19%. Thailand is currently building up large capacities for the manufacturing of EV and PHEV vehicles, while Indonesia plans to build battery cell manufacturing thanks to the country's significant raw material resources.

Automotive nations are also making good progress on charging infrastructure. South Korea is the clear leader in charging density with 75.2 charging locations per 100 km of roadway. The Netherlands follows at some distance with 21.9 charging stations on the same distance. Indeed, rising from 0.5 to 2.8 globally, the number of charging stations per 100 km has more than quintupled since the first ADR edition.

China's electric car market does not offer much opportunity for foreign OEMs

Largely unnoticed by the outside world, electric cars are continuing to penetrate the Chinese market. Besides the ability to have cars fitted out to their taste, cost has been a big factor in the success of EVs among Chinese consumers, with smaller models available from around USD 4,200. Almost all of the 10 top-selling EV models sold in China in the first half of 2021 were produced by Chinese carmakers.

Breakthrough for autonomous driving in 2030?

Advances around autonomous driving were again a focus of the study. People in Asian nations are far more confident that fully autonomous vehicles will break through into the market soon. In South Korea, 40% of respondents believe that fully autonomous commercial mobility services will be operational within nine years, an opinion held by 30% of people in Germany and the United States. At the same time, 73% of respondents worldwide think that their country is not doing enough around regulatory framework and infrastructure to support the broader rollout of the technology.

The constant rise in number of patents related to autonomous driving is another indicator of advancement: Autonomous vehicle and function patents as a share of all driving technology patents rose from 2.2% in 2017 to 5.8% in the latest study.

"We are seeing a great deal of activity in the market but the question of how OEMs are going to earn money from autonomous vehicle services remains unanswered," says Stefan Riederle, automotive expert at Roland Berger. Viable and long-term business cases are still being worked out. "In our opinion, there are three key enablers for OEMs: Offer the best connectivity, in other words high-speed internet; leverage a premium interior that can be personalized; and provide attractive direct services and infotainment content."

Topics

Companies behind the ADR Platform:

Automotive World is a leading B2B publication for the mobility sector. It draws on a global network of expert contributors to produce insightful articles, reports, data sets, forecasts, webinars and conferences. Right now, Automotive World is focusing on connected and autonomous vehicle technology, urban and shared mobility, advanced propulsion and the future of trucking.

carbometrix mission is to make companies’ carbon performance data accessible and comparable. We help decision makers direct financial flows towards a low carbon economy. We are developing the most comprehensive carbon data and rating platform in the world. We believe carbon transparency and benchmarks are essential to trigger a drastic change towards the reduction of greenhouse gas emissions.

CHARGING RADAR – Market intelligence built for the EV charging business: Understanding the development and usage of CPO and MSP networks. CHARGING RADAR uniquely combines strategic market intelligence and analyst advisory services through data, insights, and analytical tools. We enable industry leaders to make fact-based decisions to power their market monitoring, business planning, and strategic growth. CHARGING RADAR partners with industry leaders and new market entrants across automotive and utility industries, CPO and MSP networks, consulting firms, investment companies and governmental bodies to support them in their strategic planning and day-to-day operations and enables them to make fact-based decisions.

CoMotion is a global platform where leaders of the most innovative transportation and technology companies around the world meet with urban policymakers to share ideas, do business and plan the new mobility future. CoMotion organizes exclusive world-class events such as CoMotion LIVE, CoMotion LA and CoMotion MIAMI, and is the new mobility industry's premiere source for news, insights and analysis.

As a partner to the automotive industry, fka GmbH Aachen offers innovative vehicle technology solutions and strategic consulting. Starting from the complete vehicle, fka develops concepts and strategies on the key topics of sustainability, safety and mobility experience.

Roland Berger is the only management consultancy of European heritage with a strong international footprint. As an independent firm, solely owned by our Partners, we operate 50 offices in all major markets. Our 2400 employees offer a unique combination of an analytical approach and an empathic attitude. Driven by our values of entrepreneurship, excellence and empathy, we at Roland Berger are convinced that the world needs a new sustainable paradigm that takes the entire value cycle into account. Working in cross-competence teams across all relevant industries and business functions, we provide the best expertise to meet the profound challenges of today and tomorrow.

Springer Fachmedien(www.springerfachmedien-wiesbaden.de) is part of the Professional Group within Springer Nature – one of the world’s leading science and professional publishers. Working from a Wiesbaden location, Springer Fachmedien produces journals, events and online services which are tailored to engineers and managers, especially in the automotive and finance industries.